Biodiversity Credit Calculation Overview: Version 2

The most in-depth exploration of biodiversity credit calculation out there. Ingredients, recipes & dishes - the full biodiversity credit cuisine at your fingertips.

Biodiversity credit calculation is still the name of the game. The confusion is still in the air. In the meantime, the credit scheme explosion has continued.

That’s why it’s time for a second credit calculation deep dive (you can find the first here). This time, I went (much) deeper and was lucky enough to collaborate with some of the best biodiversity footprinting folks in the game - Joshua Berger & his team at BioInt. They were the force behind a more “proper” indicator & metric standardization.

Last time I said that I wouldn’t get into formula-level calculations (I can confidently say now - not without reason 🙂). But over the past year, I realized that that’s what the market (and frankly, me) needs. So this version brings not only an updated and extended database of biodiversity credit indicators & metrics (62 → 140), but also an in-depth credit calculation analysis of some of the most well-known credit schemes, both written & visual.

This might be the highest effort piece so far. I might’ve learned the most during it as well.

Here are the end results:

Disclaimers

Apart from the previous ones (i.e. we’re not making credit scheme “quality assessments” and there are bound to be some inaccuracies & assumptions), we got some new ones:

Today’s scope: voluntary biodiversity market (VBM)

From the demand perspective, the compliance markets are fundamental. They’re just out of scope this time (take a look at what Earthly is doing though).

The database is non-exhaustive

Not all information is public & quite some schemes allow for flexibility in choosing indicators & metrics for each project. It should illustrate the current state pretty well though.

Our work is based on publicly available information

Virtually everything we’ve used for this deep dive is publicly available. Even though privately we might be aware of major changes for some schemes, we’ve decided not to use such information this time.

Indicator & metric points of aggregation differ

Some are direct metrics, some are composed of multiple others, and some only list the meta-level ecosystem condition categories (i.e. composition, structure, function). We did our best to standardize them in the database.

Categorization context

What’s different?

This time, Joshua & his team led the main indicator & metric categorization. He’s spent over a decade in biodiversity quantification and has led the creation of the well-known (& adopted) corporate biodiversity footprinting tool Global Biodiversity Score. He’s now supporting the preparation of the Ecosystem Condition (EC) Protocol, an initiative to standardize ecosystem condition measurement across the board: corporate nature-related disclosures, target-setting frameworks and, of course, biodiversity credit markets.

Ecosystem condition is basically what it says it is - the quality of an ecosystem. You can find a more detailed definition in the appendix below. And as we’ll see in a bit, ecosystem condition plays a crucial part for biodiversity credit metrics.

As a result, for biodiversity credit metric categorization, we used the table below:

It’s based on some reputable literature:

System of Environmental-Economic Accounting: Ecosystem Accounting (UN SEEA EA)

The foundational system for ecosystem accounting. Most other related frameworks are built on top of it.

Taskforce on Nature-related Financial Disclosures (TNFD)

The main voluntary corporate disclosure framework for mapping out company’s nature-related dependencies, impacts, risks and opportunities (DIRO). Its metric design in the LEAP approach is largely built on UN SEEA EA.

European Commission’s The Align project

An initiative to align corporate nature accounting (i.e. CSRD, IFRS, GRI, TNFD & SBTN) and measurement approaches in the EU. The ecosystem condition plays a crucial part there.

GEO BON’s Essential Biodiversity Variables (EBVs)

The most widely accepted system of variables that describe biodiversity. Again, highly aligned to the ecosystem condition.

Why ecosystem condition though?

In short - standardization. Multiple fields are finally converging into a common way of understanding & measuring biodiversity: from (inter)national & corporate accounting or target-setting frameworks to biodiversity credit markets.

Most biodiversity credit metrics fit into these boxes well. Some have even been designed starting from ecosystem condition (e.g. Verra or Terrascape).

Of course, we’re not forgetting about the species & other metrics unrelated to biodiversity state. Starting with EC in mind allows us to reduce confusion and put the biodiversity credit-related MRV in a broader context of biodiversity footprinting & global goals though.

We’re slowly starting to speak a common biodiversity measurement language. If we can avoid speaking gibberish here, we will.

Indicators, metrics & units

Not only are there many different definitions of an indicator, metric & unit - they also often overlap. This is our attempt to get to the most fitting definitions for biodiversity credit markets & nature accounting:

Indicator: a quantitative/qualitative factor or variable to measure performance.

An indicator can be measured through one or multiple metrics.

Metric: a system of measurement used to quantify an indicator.

Unit: a defined quantity used to express a metric.

It’s an individual standard of measurement in any given system.

Example

Let’s imagine we’re looking to quantify the ecosystem condition in a mangrove forest.

One of the indicators of the ecosystem condition is ecosystem structure. One of the ways we can measure it is through mangrove root density (a metric). In turn, we can express this metric by counting the number of mangroves in a certain area. Such example unit could be #/m2.

Combine a few of these metrics in a certain way (a method) and you’ll have yourselves a quantified biodiversity credit.

From now on, for the sake of simplicity, we’ll mash the “indicator” term into “metric”. Just keep in mind that when we say “metric”, we often mean both.

Ingredients, recipe & dishes: the biodiversity credit cuisine 🍳

Wait, is this an article on cooking? Not this time. But it is the best metaphor we could think of to understand biodiversity credit calculation.

Here’s how you can think about it: every credit scheme has at least one metric (ingredient) that they quantify in a certain way (recipe) to derive the format (dish) & number of these biodiversity credits.

Just listing all the ingredients that the schemes use is valuable. What is even more valuable to folks is more information on the recipes and final dishes of these schemes. We all know that you can use the same ingredients to cook completely different dishes. The same is true in biodiversity credit markets. Nuance matters.

Let’s unpack this beautiful cuisine.

Ingredients are the easy part. The updated database is full of those. The recipe is a bit more difficult. There each biodiversity credit scheme follows a certain step-by-step method to calculate its credits. And since virtually every scheme is area-based, the methods usually involve multiplying the biodiversity uplift/avoided loss with ecosystem extent (i.e. the more proper way of saying “land/area size”).

Now, time for the (usually) most awaited part: the dish. It also happens to be the most complicated. We have three types of meta-dishes:

Ecosystem condition (EC)

First, we have the dishes that only use the ecosystem condition (EC) ingredients. The result: what the Global Reporting Initiative (GRI) & The Align project calls “condition-adjusted area”. It’s directly proportional to ecosystem condition (i.e. physical reality). Hence, we can express it in physical terms (e.g. 1 biodiversity credit = 1 percentage point uplift in ecosystem condition over 1 hectare).

Weighted ecosystem extent

This dish is different. Since it involves non-EC & non-species ingredients (e.g. management goals/practices or, let’s say, intensity of pesticide use), you can’t express them in purely physical terms. That’s where the “weighted” part really comes in.

Species-weighted ecosystem extent

This dish works similarly to the EC one except that the number of issued biodiversity credit units is proportional to species metrics and not EC metrics.

In the end, one can consider these dishes (or calculation indicators) as biodiversity credit “meta” units.

Was it difficult to follow? Us too. That’s why you’ll see all of it visualized with examples in just a bit.

The ingredient landscape 🥕

So, given the new biodiversity credit metric categorization & 10 months of market progress, where are we now? For that, we’ve built an updated biodiversity credit metric (i.e. ingredient) database. Based on it, here’s what the landscape looks like:

If one scheme uses all three types of metrics, it’s in the middle. If another only uses ecosystem-level ones, it’s in the “Ecosystem” bucket. And so on.

Ecosystem condition x ecosystem extent dominates

We’re seeing more schemes (some consciously, some, probably, not) move under the ecosystem condition & extent umbrella. That makes sense - these projects are preserving or restoring biodiversity (ecosystem condition) over a specified area (ecosystem extent).

It’s also good for the broader nature finance ecosystem. The closer we can align biodiversity uplift/avoided loss measurement with (usually negative) impact measurement, the easier it’ll be for companies (or even nations) to act. We’re not saying it’s a requirement before they do act. Not at all - that’s a dangerous assumption. If there was more political will, nothing would hold the “nature positive” action back. Such alignment of measurement would just remove one more (big) excuse for inaction.

Calculation methods: recipes & dishes 🥘

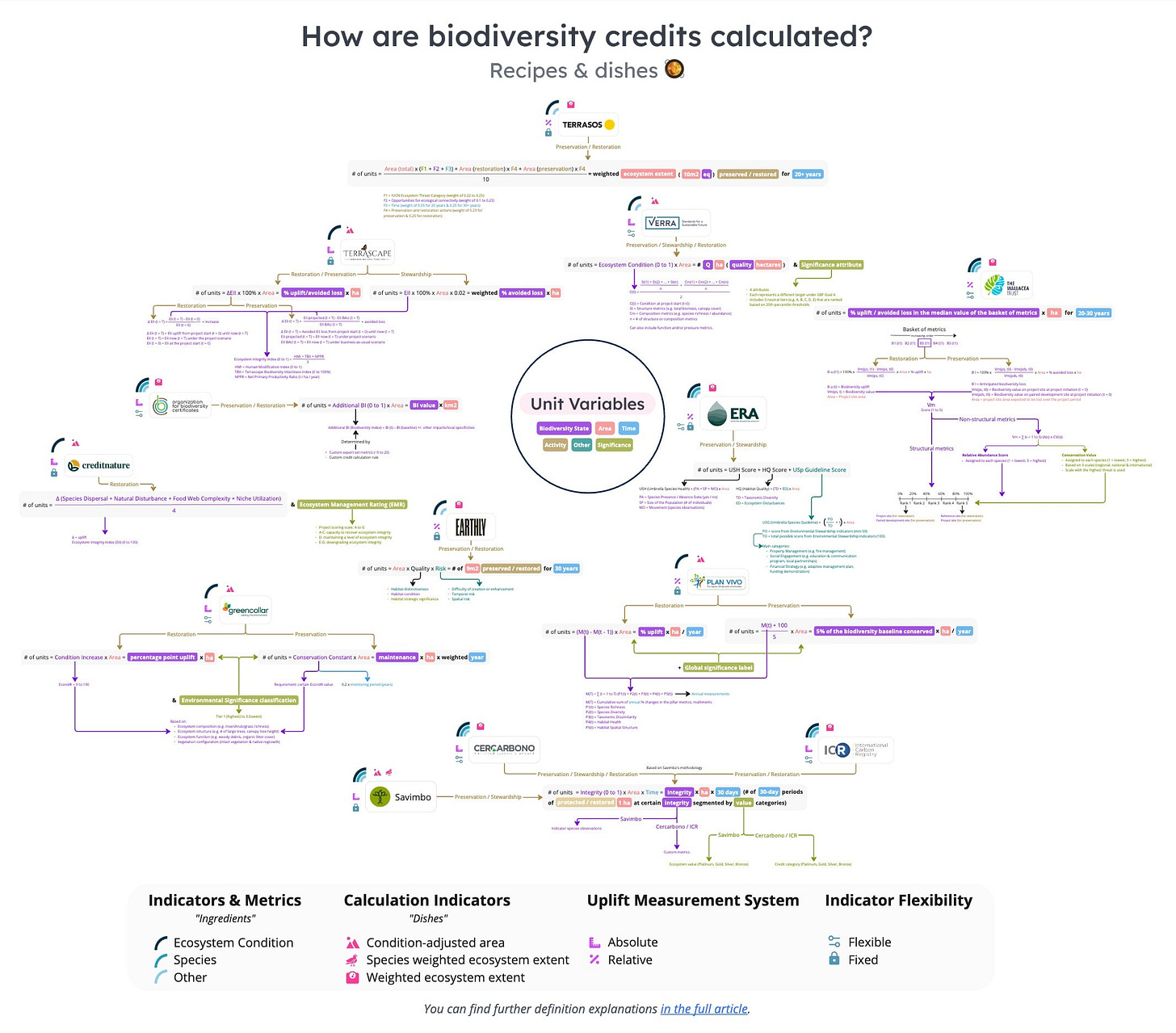

The cringe cooking metaphor continues. Let’s take a look at our attempt to visualize the credit calculation of some of the schemes (chosen by relevance & publicly available info). That is, let’s check out their recipes & dishes.

For that, we’ve built a Miro board:

Quite a handful, huh? The overlap between beauty and clarity wasn’t as big as we wished this time. Let’s dive deeper:

Context

The idea behind this illustration is not only to understand how some of these schemes actually calculate their biodiversity credits. It’s also to see how they compare to each other.

Biodiversity credit unit variables

These are the building blocks of a biodiversity unit.

Biodiversity state

The combination of ecosystem condition, species state & value and genetic diversity. Usually, schemes cover a part of it and use many different names (ecosystem integrity, ecosystem condition, habitat quality, integrity, etc.).

Area (or ecosystem extent)

The size of the land or water body of the ecosystem measured. Usually is anywhere from 1m2 to 1km2.

Time

Temporal period that a credit is associated with. It could mean anything from a certain time period over which the uplift is achieved (e.g. 1 year) to a certain time period over which an ecosystem is preserved (e.g. 30 years).

Significance

Biodiversity threat level & its carrying capacity. For example, the Amazon may hold more endangered species than the Sahara. It may also support (way) more species in total. It’s usually based on established species & ecosystem datasets like the IUCN Red List of Ecosystems or Key Biodiversity Areas. The more threatened the ecosystem & the higher its absolute biodiversity potential, the more “significant” it is.

Activity

Mostly preservation, restoration & stewardship/maintenance (i.e. local/indigenous guardianship of intact ecosystems not (yet) under direct threat). Some also support sustainable use (i.e. farming) but it’s out of scope for today.

Other

Calculation metrics that don’t fall into the biodiversity state (i.e. ecosystem condition & species). Usually focused on biodiversity pressures, risk and social/management goals.

Now, not all of these variables are directly used to calculate biodiversity credits (e.g. “Value”). They are meaningful and are meant to affect the price of the credit though.

Uplift measurement system

Absolute: a system of assessing biodiversity based on a point uplift compared to the reference.

Example: a 2 percentage point uplift from a 10% baseline ecosystem condition (100% being the undisturbed state) is considered a 2% improvement (12%-10% = 2%).

Relative: a system of assessing biodiversity based on a % uplift compared to the initial baseline.

Example: a 2% uplift from a 10% baseline ecosystem condition (100% being the undisturbed state) is considered a 20% improvement (2/10 = 20%).

Indicators

Flexible: biodiversity credit schemes that define principles for the indicators but allow project developers to choose custom indicators & metrics.

Fixed: biodiversity credit schemes that use a pre-defined set of indicators for each project.

Although the indicators are fixed, the schemes usually provide flexibility for credit projects to choose specific custom metrics for each indicator (e.g. they might choose to measure species richness through the Shannon-Wiener Index, Simpson's Index or any other method).

Analysis

A meta-method exists

Most schemes follow the same meta-method for credit calculation:

Determine biodiversity state and (if applicable) non-biodiversity variables

Might differ for restoration & preservation/stewardship projects.

Multiply it by project area

(optional) Integrate the time variable

Done either by multiplying by x time periods (e.g. years) or deciding the credit length (e.g. each credit represents 20 years of a certain area unit preserved).

(optional) Add a significance tag to it

Can be based on neutral (e.g., A, B, C, D, E) or ranked (e.g. Platinum, Gold, Silver, Bronze) labels.

The formation of biodiversity credit units

Here’s the good news - we can derive a certain credit unit for most of these schemes (they’re “taggified” & bolded in the visual). Whether it’s the “% uplift/avoided loss in the median value of the basket of metrics per hectare for 20-30 years” or “number of 30-day periods of protected/restored 1 hectare at certain integrity segmented by value categories”, that’s a unit. Can we have dozens of different units in a functional high-integrity market? We’ll see. Either way, being able to explain to anyone what a single credit is in simple tangible and, ideally, easily measurable terms is the golden standard, in our eyes.

Activity matters

Although surprisingly easy to forget, activity is a crucial variable of a biodiversity unit.

It’s integrated in two ways:

Credit calculation

Some schemes use different weights for restoration & preservation projects (e.g. Terrascape, GreenCollar or Terrasos) while others use different calculation formulas altogether (e.g. Plan Vivo).

Activity tags

While the formula remains the same for either activity, the credits receive the activity tags they represent. It’s crucial information for buyers and is meant to fetch different prices.

Area: the foundational variable

Virtually every credit scheme is built around area (or more properly - ecosystem extent). Even most of the practice-based ones. Directly integrating it into a biodiversity unit makes the unit easier to understand as well. We might be biased but unless you’re an edge case, your biodiversity units should probably represent a specific area unit. (e.g. m2, ha or km2).

Time: the enigmatic variable

The fact that area-based biodiversity credits are the easiest ones to quantify is well established. Time is a more delicate variable.

We can look into how time is integrated in two ways:

Pre-defined duration

Time isn’t part of the credit calculation but each credit has a pre-defined duration. It’s based either on credit length (e.g. 20-30 years) or verification period (usually 1-5 years).

Explicit credit calculation

Here folks follow a certain version of the “outcome/activity x area x time” formula. It’s more applicable to preservation/stewardship projects (e.g. Savimbo).

Some schemes don’t mention time at all. It probably means they assume a pre-defined duration. Otherwise, they’d implicitly be guaranteeing indefinite biodiversity outcome permanence. Unless you’re Wilderlands and your business model is built around that, you probably can’t afford to make those claims.

Credit length vs durability

Biodiversity credit length and durability somewhat overlap. A credit length of 20+ years guarantees some sort of durability over that period. However, what about credits that represent a shorter time frame (e.g. up to a year)? Ensuring positive outcomes for such a short time is not as attractive without additional guarantees for some. That’s where Eric Wilburn’s subscription model might work well.

Credit vintage & speed of biodiversity gains

Biodiversity credit vintage and speed of gains matter. The likely reasons are:

Biodiversity credits might also suffer from the “time value of carbon” effect. We’re seeing that more recent carbon credit vintages are priced higher. The likely reason is the collective belief that the market “got its act together” as time went by. Directionally, it’s reasonable to believe that better standards, governance, MRV (read: transparency) & increasing policy-level integration will indeed increase credit quality. It’s definitely not always the case though.

Biodiversity loss is not only irreversible. It’s also time-sensitive. Ideally, we achieve gains as fast as possible. And do so before experiencing losses.

There’s one potential negative in prioritizing faster biodiversity gains - the incentive for project developers to game the system & achieve them, but only on paper. Something to be aware of when building market guardrails.

Biodiversity credit markets <> nature accounting: where are we?

Unlike the comparison last year, let’s move beyond metrics & look one level higher - the ecosystem condition.

Biodiversity credit markets

Not much to say here - ecosystem condition is, both explicitly & implicitly, becoming the dominant definition of healthy ecosystems that most credit schemes directly focus on. 30 out of 35 that had any data on the metrics they use, as a matter of fact.

Nature accounting

Nature accounting is a broad concept for anything that tries to integrate nature into financial decision-making. Here, we’ll specifically focus on nature-related corporate disclosure & target-setting frameworks.

Alignment around ecosystem condition is increasing

Taskforce on Nature-related Financial Disclosures (TNFD)

Under metric C5.0, TNFD mentions ecosystem condition & species extinction risk.

Corporate Sustainability Reporting Directive (CSRD)

CSRD’s ESRS E4 Biodiversity and ecosystems standard covers both ecosystem extent & condition under paragraph 41 of Disclosure Requirement E4-5 Impact Metrics.

Global Reporting Initiative (GRI)

GRI is one of the first and most comprehensive sustainability reporting frameworks. Their recently updated biodiversity standard explicitly covers ecosystem condition, ecosystem extent & species population/extinction risk under disclosure 101-7 “Changes to the state of biodiversity”.

Science Based Targets Network (SBTN)

SBTN is the first global (voluntary) corporate target-setting framework for nature. Even though it doesn’t have biodiversity-specific targets & metrics (yet), biodiversity and ecosystem condition/integrity are weaved into its Steps 1 (”Assess”) and 2 (”Prioritize”).

Most frameworks don’t specify ecosystem condition metrics to be used. There are too many & most depend on the context.

Alignment between each framework is increasing

Basically each nature accounting framework is working to align itself with others (e.g. CSRD’s EFRAG & TNFD, SBTN & TNFD or GRI & TNFD). Needless to say - that’s awesome.

The importance of aligning both

We’ve already alluded earlier that aligning the biodiversity market metrics with the nature accounting frameworks is crucial for the markets to pick up.

The biodiversity credit markets lack concrete demand from the private sector. Biodiversity is such a new topic for corporates - most won’t move until moved or until they have a nature strategy in place. With the legal risks from the carbon credit greenwashing backlash, they have a great excuse to sit on the sidelines. But once their nature strategy & targets are in place, biodiversity credit markets might be in a great position to help corporates contribute to global nature goals (and maybe even address their nature risks one day). If both nature accounting frameworks & biodiversity credit schemes speak the same language on measuring nature (i.e. ecosystem condition and its metrics), both sides would benefit from it. Corporates would also have an easier time to justify purchasing these credits.

So yes, nature accounting is shaping biodiversity credit markets. It is the leading indicator of corporate (and maybe even governmental?) action and, as a result, credit demand.

Parting thoughts

Conceptually, this is definitely the most challenging piece of work so far. You’re not supposed to get it in one go. No one is. There are so many challenges ahead. However - slowly but surely, nature measurement pieces are coming together across different fields. Ecosystem (i.e. condition & extent) and species (i.e. population size & extinction risk) are becoming the unifying concepts in practice as well. We remain skeptical optimists.

Thanks for reading 🙏

And once again:

Appendix

What is ecosystem condition?

Disclaimer: for ecosystem condition and all other related concepts in this section, we’ve used UN SEEA EA’s definitions.

Ecosystem condition is the “quality of an ecosystem measured in terms of its abiotic and biotic characteristics”. Biotic: living; abiotic: physical/chemical.

Most relevant components

Composition

The “composition/diversity of ecological communities at a given location and time”. “Communities” is the keyword. Composition focuses on species assemblage and their relative abundances.

For those who read my biodiversity credit calculation overview last year, most metrics that I categorized under “species” (e.g. species richness, species diversity, taxonomic dissimilarity) are actually ecosystem composition metrics. True “species” metrics focus solely on the individual(s) within a single species with no relation to the whole community in the ecosystem. My non-ecologist eye missed that.

Structure

The “aggregate properties (e.g., mass, density) of the whole ecosystem or its main biotic components (e.g., total biomass, canopy coverage, annual maximum normalized difference vegetation index (NDVI))”.

They are important tangible puzzle pieces that help you understand the bigger picture - ecosystem condition. It might be the most difficult one to grasp because it can be so many different things.

Function

The “summary statistics (e.g., frequency, intensity) of the biological, chemical, and physical interactions between the main ecosystem components (e.g., primary productivity, community age, disturbance frequency)”.

“interactions” is the keyword here. We’re looking for the activity of these ecosystems. Generally, the more active, the healthier and biodiverse.

Landscape

The “metrics describing mosaics of ecosystem types at coarse (landscape, seascape) spatial scales (e.g., landscape diversity, connectivity, fragmentation)".

“scale” is the keyword here. Landscape metrics take a bird’s-eye view of the ecosystems. That is its core difference from ecosystem structure.

I'm particularly interested in how these biodiversity credits will interact with corporate sustainability efforts. As companies face increasing pressure to address their environmental impacts, biodiversity credits could become a valuable tool. However, there's a risk of these credits being used as a form of greenwashing (as always) if not properly regulated and understood.

The alignment between biodiversity credit markets and nature accounting frameworks is a positive development. It could create a more cohesive approach to managing biodiversity impacts across different sectors and scales.

While challenges remain, the progress in this field is promising. It represents an important step towards quantifying and valuing biodiversity, which is crucial for its conservation in our economic-driven world.

This is truly a very detailed and informative piece of content. Thank you so much for providing such an in-depth look at biodiversity credit calculation.

Fantastic insight thank you for sharing