Biodiversity Credits: Assets or Commodities?

A deep dive into different visions of biodiversity markets that led me to the root of standardization - a biodiversity unit.

Hi folks 👋

For those who don’t know me, I’m Simas from Bloom Labs - a biodiversity finance newsletter & consultancy. I focus on all things biodiversity markets, nature accounting & biodiversity measurement, reporting and verification (MRV).

Cheers!

If you asked ten people on the street “what is a credit?”, you would likely get ten different responses. If you do the same with “what is a biodiversity credit?” in a room full of nature-based solutions folks, the response diversity might not differ that much.

Let’s take it up a notch though. Let’s ask “what kind of financial instrument is a biodiversity credit?”. That’s the question I’ve been asking myself (and many others at the cutting edge) for the past half a year. No clear answers yet. So I decided to dive deeper and see what I’m left with.

This isn’t just a fun intellectual exercise. If the voluntary biodiversity market (VBM) players understand and agree on the properties of the credits they’re selling and buying, we might progress in multiple gnarly topics (e.g. agreeing on a biodiversity unit, improving outcome integrity, nailing credit use cases or finally convincing corporate buyers).

Let’s get into it.

What is a credit?

But first, let’s agree on what *a* credit (not credit in general) is. It’s that elusive term that is used (and misused) in many contexts.

A credit is a unit of value. Simple as that. Whether it’s a bank loan, a university credit (earn enough of them and you’ll have a degree - many consider that value), a form of video game or tax rewards. Technically, you could consider a $5,000 salary as 5,000 credits that each month are converted into dollars on a one-to-one basis.

I look at credits as money with limited use. While money is the universal medium of exchange, credits have restrictions on how they can be bought, sold and used. Just like money, credits need to be either earned or paid back. A transaction is at the core.

In financial accounting, credits became a reliable tool to manage standardized units of value. As financial and environmental accounting are finally merging, the concept of credits has entered the environmental field as well.

What kind of financial instruments are biodiversity credits?

Biodiversity credits don’t neatly fall into one of the existing financial instrument categories and are called by many names: credits, certificates, tokens, assets or coins. The names don’t matter though - cold hard properties of the instruments do. Functionally, biodiversity credits fall somewhere between assets and commodities.

An asset is anything that produces economic value without being directly consumed in the process. Think property, equipment, patents or even goodwill. On the contrary, commodities are interchangeable units of goods that are consumed either in the process of creating economic value or by the end consumer. Think oil, gold or wheat.

Let’s forget for a minute that, technically, commodities are also assets and compare both in a table, parameter by parameter.

I’ll focus on the most relevant subset of assets to us: land. I’ll then compare the land assets and commodities with an *average* biodiversity credit scheme and assess if the current schemes function more as assets or commodities.

Usage

Just like commodities, biodiversity credits are meant to be consumed via retirement. That’s one of the defining commodity features of biodiversity credits.

Demand drivers

They vary for land and commodities as it is. As the biodiversity market has come to accept, the biodiversity credit demand drivers are even more uncertain so far.

Fungibility

Although environmental credits are technically commodities, most aren’t fungible in practice. That’s especially true with biodiversity credits so far.

Ownership

Folks usually acquire land assets for the long run. While most biodiversity credit project developers don’t purchase lands and credit ownership is likely short-term, these projects come with lengthy land use restrictions. In some cases, that’s functionally equivalent to land acquisition. It’s an especially touchy subject in Indigenous lands.

On the other hand, commodity-like biodiversity credits sell outcomes without restricting the land use activities of the locals. Potentially genius for preservation in the Global South (direct payments with a lower neocolonialism risk) and catastrophic in the Global North (risk of gaming the system with no permanence).

Physical dimensions

Most biodiversity credits are activity, area and time-based (e.g. x activity/outcome over y hectares for z years). These are dimensions. They aren’t standardized yet though. Hence, they resemble land assets more for now.

Market structure

Building on standardized and fungible units, commodity markets can afford to run on a simpler (read: cheaper) market structure. Land markets can’t replicate that. Neither can the VBM, so far.

Claims policy

Again, a feature built on standardized and fungible units. It allows commodity markets to be stricter and more consistent with quality requirements and claims policy. Land markets don’t have such luxury - the world is riddled with land disputes, especially in traditionally Indigenous lands. The biodiversity markets still resemble the latter.

Liquidity

Another derivative of standardization. Since the properties of the products transacted are well-aligned, there are more willing buyers and sellers at the same time. Biodiversity credits have a long journey to get there (some say an impossible one).

Date of expiry

It’s a weird feature to explore for units of value we can’t (technically) touch, feel or hear. It remains an open-ended subject for biodiversity credits.

What do we see?

In theory, all environmental credits function as commodities. In practice, the early maturity of biodiversity credits shows: low standardization, high complexity, illiquidity, unclear market rules and no fungibility. So far, biodiversity credits function more like assets stuck in the body of a commodity.

What actually matters?

In reality, it doesn’t matter if biodiversity credits are more like assets or commodities. What matters is the on-the-ground social and nature outcomes. For that, let’s look at these three properties:

Impact

Example metrics: biodiversity outcomes (e.g. hectares restored/preserved, species recovered, etc.), ecosystem services, total money that reaches the ground, number of livelihoods improved.

Social metrics are usually the leading indicators of project success. If local lives are improved, we should also see *long-term* biodiversity improvements.

Efficacy

That is, the proportion of total funds that reach the ground.

That’s where it gets interesting: larger financing leads to lower efficacy. While small projects can sometimes ensure even 80-90%+ benefit sharing, the larger projects cannot. Now, the proportion of the administrative costs generally improves with extra large projects. They do tend to be more exclusionary though - few can organize projects at such scale (e.g. 100,00ha+). Either way, the project financing dynamics often lead to them.

Use of funds

People debate how the credit proceeds can be best used. Some propose cold hard cash payments, others prioritize sustainable development (e.g. healthcare, education, infrastructure, etc.).

Different visions

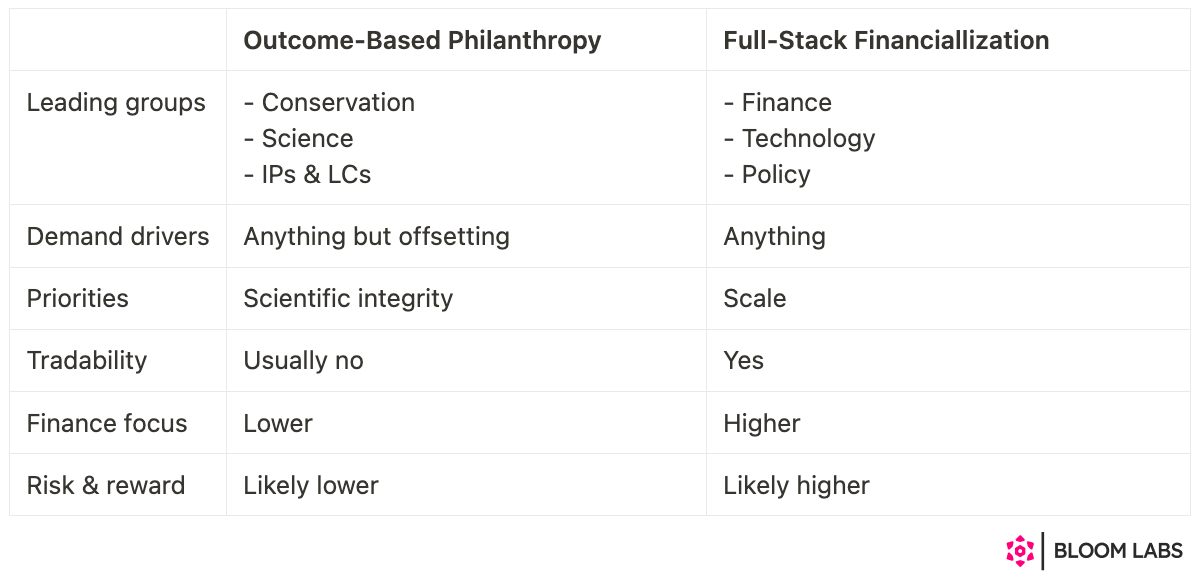

Different groups within the biodiversity market want biodiversity credits to be different things. I’m seeing these two schools of thought:

Outcome-based philanthropy

This vision is represented by conservationists, scientists and often both Indigenous Peoples and local communities (IPs & LCs). It’s driven by science, outcomes and supply. Folks here often consider biodiversity credits and offsets to be separate financial instruments. The core focus - achieving high integrity nature outcomes. Many in this category would probably disagree with me using the word philanthropy but the result of the extreme end of this vision is functionally.. philanthropy.

Full-stack financialization

This vision is represented by the finance, tech and policy folks. It’s driven by “reality”, systems and demand. People here usually consider offsetting as a verb that is part of biodiversity credits (a noun). It’s also more focused on building financial instruments in a format familiar to the finance sector.

Let’s also do a rough comparison of these:

Demand drivers

While both visions would take any demand they could get (I mean who wouldn’t at this point), there’s one big difference: offsetting. The finance-first folks will literally take any demand driver but most of the other group members remain strongly against offsetting based on moral, scientific and practical grounds. An issue with deciding if offsetting is “good” or “bad” is the lack of a true counterfactual. Proving that social and nature outcomes would’ve been better without offsetting is difficult, just as doing so the other way around.

Priorities

The outcome-based philanthropy folks tend to prioritize scientific integrity over everything. That means ensuring that the biodiversity outcomes are transparent, real, permanent, additional and leakage-free. In theory, nobody would say no to such results. The “financialization” folks are more driven by practical realities though. They tend to prioritize aligning biodiversity credits with the existing financial markets to reach meaningful scale.

Finance focus

Unsurprisingly, the “full-stack financialization” camp is more focused on designing biodiversity credits that would be comparable with other traditional financial instruments (e.g. certain assets or commodities). That’s one of the ways they want to integrate nature into the financial system. As a result, they do more work on the market and legal structure of biodiversity credits.

Risk & reward

Both risk and reward are proportionate to the scale of the biodiversity market. As scale increases, so do the stakes. In a perfect world, we’d have the largest and highest integrity market possible. It’s difficult to avoid some tradeoffs between them though.

The ultimate nature asset vision

The Landbanking Group (TLG) represents the purest attempt to design a brand new nature asset class. Their scope is too broad to be categorized only within the VBM but I would rob you if I didn’t share their vision. It’s impossible to do it justice in a couple of paragraphs though. For more, check out their Nature Equity consultation paper.

TLG is a natural capital market infrastructure provider that’s building a new asset class they call Nature Equity. It’s a balance sheet-grade representation of nature, defined by the land’s health metrics in biodiversity, carbon, water and soil. The goal: merge financial and environmental accounting by considering nature as an intangible asset. That asset represents commercial value for investors through the exposure to safe physical assets in their supply chain/neighborhoods, proof of climate/nature remediation, delivery on government requirements, and a right on an intrinsic scarce value. If it’s difficult to grasp the idea, you’re not alone.

To pull this off, TLG is building the MRV aggregation, legal, market transaction, science, data management & assetization layers.

Example

Let’s see how Nature Equity is supposed to operate. I usually imagine this scenario:

Corporate A buys Nature Equity assets for $100,000

Nature Equity worth $100,000 appears on the left side of their balance sheet (”assets”)

Cash balance decreases by $100,000 from the left side of their balance sheet (”assets”)

The Nature Equity is revalued through periodic MRV assessments

Corporate A can sell the Nature Equity to others

Use cases

As with most infrastructure providers, the possible use cases are only limited by one’s imagination (e.g. tax benefits, store of value, profits, portfolio diversification, etc.). The most relevant ones now are insetting, offsetting, land investing and integration into financial products (e.g. nature-risk-based insurance and banking products, nature-linked/green bonds, etc.).

Potential

TLG is the first serious attempt I’m aware of to actually integrate nature into finance. The vision is inspiring. I mean, who wouldn’t love the fact that nature is our critical infrastructure reflected in our economies.

Concerns

The implementation of this vision, as well-meaning as it might be, is full of threats:

Land grabbing

TLG folks acknowledge that cross-border land purchases this infrastructure might lead to are not desirable. They are adamant that these Nature Equity contracts do not represent a land title deed. Ensuring that’s the case in practice is a different challenge.

Conflict of interest

Innovating on so many different layers at the same time usually requires concentrated decision-making. It makes sense in the early stages of new markets. TLG must ensure high integrity independent governance of their infrastructure over time while remaining on a venture-backed trajectory. That’s not easy.

Should biodiversity credits be assets or commodities?

Few will deny that “nature is our most valuable asset” sounds a whole lot better than “let’s commoditize nature”. These perspectives are not that different though - they just emphasize different parts of the nature value chain. Here’s one way to think about it from the financial perspective: the natural ecosystems (read: land) are factories (read: assets) that produce ecosystem services (read: commodities).

As always, “either or” is a trick question. “when” is the real one. Here, ownership becomes the most important characteristic in deciding that.

Global North and Global South

The most ironic lesson I’ve learned over the past years is that folks who are trying to make things better are also in the perfect position to make them worse. The intentions are usually good. The results might not always be such. It’s a scary realization.

The current (long-term) broken financial system is serving the existing power structures. And the many painful changes required to align our economy with planetary boundaries won’t happen just by asking nicely or inspiring companies to become “nature positive”. That’s why, as we work to scale private nature finance, we must be careful not to further entrench the reasons we’re in this historic social and environmental crisis.

One of the most important axes of entrenchment is land ownership, especially in the context of Global North and Global South. Long-term asset ownership or functional use restrictions is one of the core features of an asset. Such land “assetization” can work fine in wealthy sophisticated jurisdictions with long-standing private property traditions (read: Global North) but can also become just another form of neocolonialism in poorer jurisdictions with weaker historical private property traditions and significant Indigenous lands (read: Global South).

Environmentally, the current nature assetization wave in the Global North seems promising. For example, dozens of British companies are buying up land to rewild pastures or convert them into forests (sometimes even native and biodiverse!) to generate biodiversity/carbon credits, produce tangible goods (e.g. timber) and profit from land price appreciation. Increasingly more asset managers are raising 9-figure funds to run a similar playbook (e.g. Gresham House, Foresight Sustainable Forestry Company or Mirova). Socially, this assetization might not be as glamorous: it can result in further land ownership concentration since a significant part of the bought-out lands seem to be previously owned by smallholders.

This particular wave is led by England’s Biodiversity Net Gain, a policy that requires land developers to deliver biodiversity gains of at least 10% by following the mitigation hierarchy and then utilizing biodiversity units/credits. Once again, we’re seeing markets follow policy.

Lessons

Terminology aside, I see some lessons applicable across the board.

Nature finance shouldn’t lead to increased inequality

No matter if you consider biodiversity credits assets or commodities, the rising interest in private nature finance is leading to some form of land assetization (or at least speculation) globally. It shouldn’t be used as a way to further aggregate land ownership and displace smallholders, minorities or Indigenous Peoples. The global land squeeze has been happening for most of this century already: companies and individuals from wealthy economies are buying up land across the globe for industrial food production, resource extraction and speculation. It perpetuates inequality. Transparency, free, prior and informed consent (FPIC), fair benefit sharing, standardized outcomes and flexible contractual obligations are some of the key properties that must work well for biodiversity markets not to make these neocolonial trends worse.

Again, the social and environmental crisis is the same crisis. We can’t solve one at the expense of the other. At best, it’d be a short-term fix. We need to find ways to value land at scale without stripping individuals of its ownership. Having said that, I do appreciate the unbelievable difficulty in coordinating regional nature action without concentrated land ownership.

We need more standardization

Biodiversity unit

We’re finally seeing the basic biodiversity unit structure emerge, especially for land-based credits. Pollination has visualized it well below.

Indicators and metrics used to calculate biodiversity credits are also standardizing. More schemes use ecosystem extent and condition metrics together with the species richness and diversity ones. I’ll soon explore this further in version 2 of the biodiversity credit calculation overview.

I’m seeing a couple of differences between initiatives to standardize the biodiversity markets though:

Species-centric & human-centric approaches

Some meta stuff. The species-centric approach prioritizes the maximization of global species and ecosystem diversity - the definition of biodiversity. On the other hand, the human-centric approach prioritizes the ecosystem services that directly boost economies and can be converted into a dollar value. Now, ecosystem services rely on biodiversity but some life forms get inevitably discriminated against if they don’t offer enough *local* economic value to humans.

The species-centric approach is more valuable from a global biodiversity perspective but has weaker pricing power compared to the human-centric one. If it had stronger pricing power, we would have many times more capital flowing to the equator territories instead of mostly temperate industrialized lands.

High & low-level standardization

High-level (or “soft”) unit standardization is the default outcome when led by large consortiums (e.g. IAPB, BCA, WEF). A great example is BCA’s recent paper about the definition of a biodiversity credit. The most likely end outcome is agreeing on a common set of metrics, not a unit. Functionally, it reflects the asset perspective more. In practice, we’re seeing that achieving low-level (or “hard”, with well-defined dimensions) unit standardization is easier when fewer parties run the game. The political comparisons here are ample.

The low-level unit standardization is primarily pushed by a fellow biodiversity credit methodology and project developer Savimbo. It promotes a species-centric, commodity-first approach. Their goal is for the market to adopt a methodology-agnostic unit that would make the buyers’ lives easier while still allowing biodiversity credit schemes to differentiate themselves with their unique methods of measuring biodiversity.

Here’s how it works:

Unit = Area (1 ha) for Time (1 month) with Integrity (scale from 0 to 1, as determined by unique methodologies) categorized by Value (Platinum, Gold, Silver, Bronze).

Area

Area-based biodiversity credits are becoming the norm. 1 ha is the most common terrestrial area unit.

Time

1 month might seem an oddly short time. It was chosen to achieve similar (read: competitive) pricing with carbon credits (generally < $10) in most commodities exchanges. Whoever wants to buy a year-long outcome can just buy 12 credits.

Integrity

Ecosystem health. 0 is a completely degraded ecosystem. 1 is a completely intact ecosystem.

Value

That’s where the species-centric approach comes in. It signifies the biodiversity potential in an ecosystem. Lands with higher potential are valued higher.

The ideal outcome - biodiversity credit schemes agree on the dimensions of a biodiversity unit. It comes with some restrictions and assumptions: area & time units and, most importantly, a species-centric perspective. Not every scheme is incentivized to adopt it. The price to global biodiversity outcome ratio is far better in the equator countries. This unit implicitly argues that we should prioritize biodiversity hotspots first. Some fear it might come at the expense of the existing nature finance flows in the (less biodiverse) industrialized economies.

Benefits of a biodiversity unit

Credit interoperability

A reliable biodiversity credit outcome comparison would help to ensure outcome integrity. Quality assurance is simpler when we have a common yardstick to measure it. It would also make the lives of basically every market player easier: especially the buy-side (i.e. buyers & demand facilitators) and, as a result, the sell-side (i.e. credit schemes & local nature stewards)

It doesn’t mean that we’d end up with a global biodiversity market. A standardized biodiversity unit might help in spinning up healthy local bioregional markets with some cross-market price discovery though.

Streamlined impact reporting

One gaping hole in scaling nature recovery is the lack of common language across impact reporting. Biodiversity credit schemes use their metrics and units. Corporate disclosure and target-setting frameworks use theirs. Local and (inter)national jurisdictions - theirs. The bigger the overlap between all of these, the easier it is to coordinate nature action at scale.

Market integrity & scale

Generally, commodity markets are simpler than the asset markets (especially land). Result: lower transaction costs, shorter simpler ownership, more centralized and clearer market structure, standardized stricter claims policy, standardized physical dimensions and higher liquidity.

The more variables we can remove, the fewer risks we’ll be dealing with and the more opportunities for genuine nature impact we’ll have. Biodiversity unit standardization gets us (much) closer to this.

Although Savimbo is making a lot of noise (& progress), the market participants remain cautious. Especially fellow biodiversity credit standards and methodologies. The caution is understandable: Savimbo is also a biodiversity credit project developer with strong views and incentives. That makes it easier to consider the proposed unit as a “Savimbo unit” instead of a “brand-free fully open unit”.

Market structure & claims policy

We would already achieve many market structure and claims policy standardization benefits by agreeing on a biodiversity unit. Nevertheless, we need additional guardrails for supply quality (e.g. biodiversity version of ICVCM), buyer claims (e.g. biodiversity version of VCMI), engagement with both Indigenous Peoples and local communities or benefit sharing, just to name a few. It looks like the voluntary biodiversity market (VBM) is following the voluntary carbon market (VCM), in a compressed timeline.

Scientific integrity

As expensive and slow as it is, it’s a non-negotiable. Since environmental credits are invisible & untouchable and ecosystem science (forever?) incomplete, we need to maximize buyer trust in real, verifiable, additional activities and outcomes. Science (both modern and traditional) gets us there.

Regulations

It’s becoming a tradition of mine to point out the importance of policy and regulations in environmental markets at least once in each article. Today is no different. We’re seeing that corporates won’t invest in nature at scale unless they either 1) see direct commercial benefit from it, or, 2) are forced to. Since the former is still a tough sell (limited MRV and ecosystem modeling capabilities + short-term corporate governance incentives = not the best combination), we should rely on the latter more. Not only is it the guiding signal for environmental markets, but regulations is a big reason corporates are doing anything about nature to begin with, market-related or not.

Final notes

This wasn’t supposed to be a 17-page behemoth. Here we are though :)

At the moment, biodiversity credits are functionally more assets than commodities. They will probably always remain in the middle between the two. However, more commodity-like features (especially biodiversity unit standardization) would help the market scale both with higher integrity and faster.

Ideally, we wouldn’t even need to have these intricate discussions. Ideally, we’d all agree that nature is sacred and hence priceless. That’s not the global economic system we live in. Some believe that we’ll out-innovate the environmental crisis. Others are looking for radical changes. And most nature finance folks are working to integrate nature into our financial system before it’s done eating itself alive. I welcome any earnest efforts.

P.S. Thank you to the countless amazing folks who shared their expertise on the subject. 🙏

Fantastic Simas!!…thanks!!…so well explained…lots of new learning for me…triggering ideas and possibilities to bring more impact in our offerings…

Thank you for this! Super useful for someone coming from the ecological literature trying to expand into markets, financial tools etc. for biodiversity. Saving this for future use. You have a new subscriber!