Hi folks 👋

For those who don’t know me, I’m Simas from Bloom Labs - a biodiversity finance newsletter & consultancy. I focus on all things biodiversity markets, nature accounting & biodiversity measurement, reporting and verification (MRV).

Cheers!

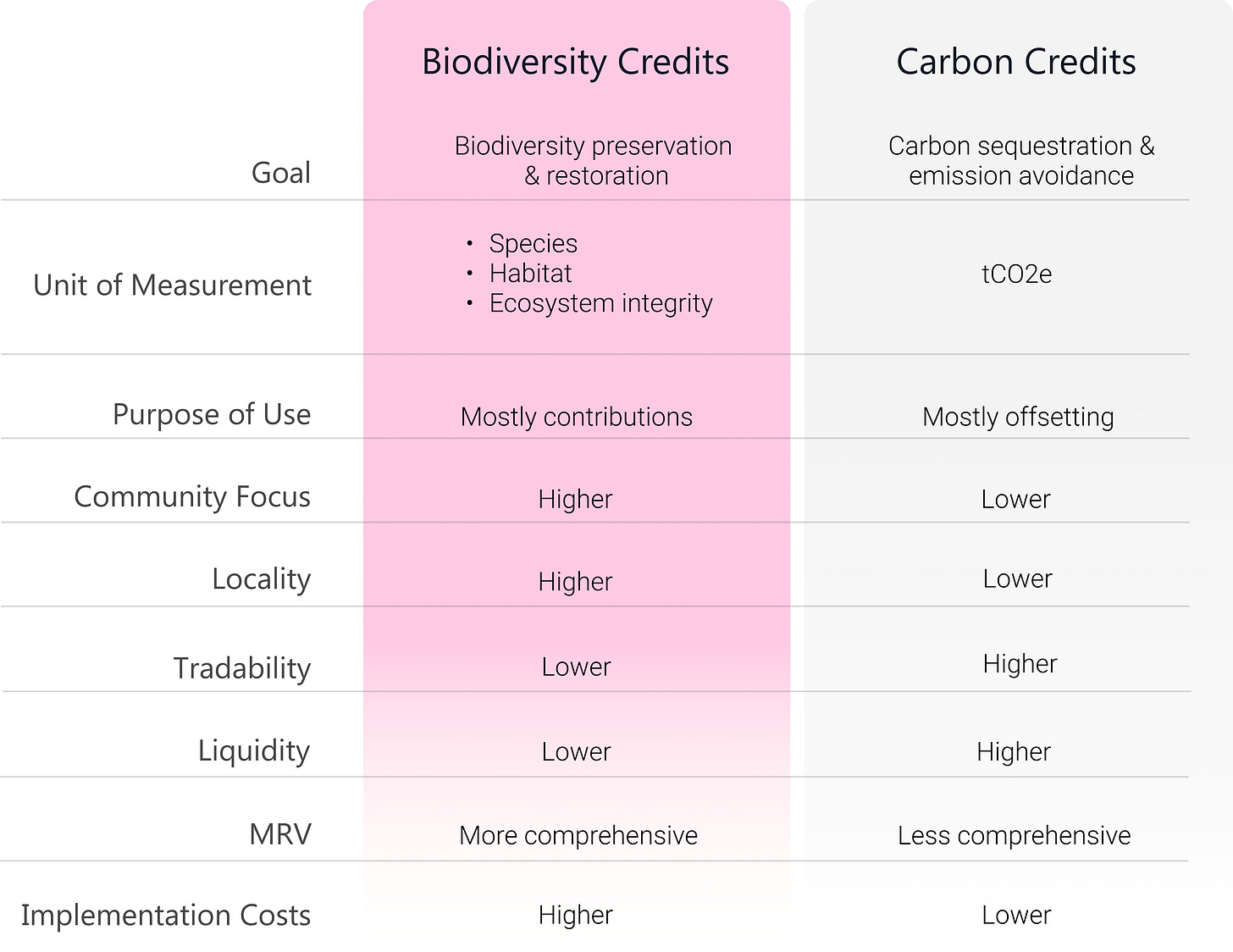

The first question I get from corporates interested in biodiversity credits is “how are they different from carbon credits?”. That’s a fair question which I will do a deeper dive on. Let’s dig in.

Basics

First, some context for newcomers. Carbon credits have been around since the 90s and most companies are at least somewhat familiar with them. Their goal is to reduce global carbon emissions. Biodiversity credits have only hit the scene in the past few years though. Correspondingly, they aim to preserve and restore biodiversity globally.

The already growing interest in these new credits has been accelerated by the Kunming-Montreal Global Biodiversity Framework agreed at the UN Biodiversity Conference (COP 15) in December 2022. The framework pledged to mobilize at least $200b/year to biodiversity by 2030 and stop biodiversity loss by 2050, among other things. It’s become the biodiversity equivalent of what the 2015’s Paris Agreement is for climate. Brand new voluntary biodiversity markets, powered by biodiversity credits, have been positioned as potentially one of the primary ways to bridge the ~$700b biodiversity finance gap.

Biodiversity Credits vs Carbon Credits

So, how different are biodiversity credits from their carbon counterparts? Frankly, operationally, they are surprisingly similar. Biodiversity credits are designed on the shoulders of carbon markets with extra focus on its biggest historical hurdles (i.e. better baselining, enforcement of additionality & permanence, prevention of leakage, community engagement, etc.).

There are a number of differences though:

Let’s dive in.

Unit of measurement

Arguably the most important difference. All carbon projects are measured by tonnes of CO2e sequestered or emissions avoided. That simplifies many things: comparing & trading different credits, claiming credit benefits, communicating projects to the public, estimating revenues, pooling credits and more. End result: more standardized carbon markets.

Biodiversity credits, on the other hand, don’t have a universal unit of measurement. Most credits fall into one of three categories:

Species

Species-based units focus on individual (or aggregated) species conservation and measure metrics related to species populations. Two most popular ones are species richness (number of different species in an area) & abundance (number of individuals of a particular species in an area). For example, the Botanic Gardens Conservation International’s Biodiversity Impact Credits scheme measures the proportion that the project added to the total tree species population.

Habitat

Habitat-based units usually focus on specific habitats (e.g. forests, wetlands etc.) and associated species while heavily relying on land size metrics (e.g. 1ha). For example, each Wilderlands’ Biological Diversity Unit represents 1m2 of perpetually protected or restored habitat - land size is the core metric.

Ecosystem integrity

Ecosystem integrity-based units are concerned with the highest-level health and functionality of ecosystems, considering the interactions between multiple species, habitats, and ecological processes. For example, a pioneer in the ecosystem integrity space, CreditNature, tracks metrics for species dispersal, natural disturbance, food web complexity, and niche utilization. These are all ecosystem-level metrics.

Unsurprisingly, that makes it difficult to standardize and scale biodiversity markets. Buyers struggle to compare different credits, assess credit quality, transact them and understand the exact claims they can make.

Purpose of use

Carbon credits are primarily purchased and retired to offset the buyer’s emissions. However, there is an increasing movement to use retired carbon credits as mitigation contribution claims to the environment and the climate crisis. Core difference: it doesn’t allow companies to skip the hard work of reducing their emissions and claim that they are carbon neutral just by retiring carbon credits.

On the other hand, most voluntary biodiversity credits do not support offsetting. Nature is inherently unique and restoring one habitat simply cannot “offset” the destruction of another (caveat: some exceptions exist for credits using species-based units). That’s why the core use case of these credits is general contributions to nature that aren’t equated to any damage done. We have yet to see how the corporate buyers will react to this change.

Community focus

Both nature-based carbon and biodiversity projects directly depend on the local land stewards. If their livelihoods are not improved, it’s naive to expect the projects to succeed.

However, since biodiversity is fundamentally local and is intimately tied to ecosystem services (e.g. fresh water, food, fuel, resources) that communities rely on, biodiversity credit schemes generally put more focus on community well-being than the carbon ones. That’s why more biodiversity standards stress community buy-in, operational involvement, explicit benefit sharing and even trading royalties (you can find an overview of the exact numbers in a list of biodiversity schemes I’ve made earlier). Having said that, even in most of the upcoming biodiversity credit schemes, neither Indigenous Peoples (IPs) nor Local Communities (LCs) are taken into consideration enough.

Locality (& Tradability)

Carbon credits are built on global units. Hence, in theory, it doesn’t matter where the carbon removals/avoidance comes from - they have the same planetary impact. This dynamic helps create global carbon markets since a buyer is mostly free to buy credits from any country in the world.

Biodiversity credits, on the other hand, are more tied to their location. That makes them fundamentally less tradable. Not only do biodiversity credit units (still) widely differ, it is also tougher to make the case for non-local biodiversity credit purchases. If you’re a company responsible for specific local biodiversity loss, you’re also responsible for preserving/restoring these local ecosystems first before looking to support them outside. That also makes business sense. That’s why biodiversity insetting and local biodiversity markets are a more natural use case for biodiversity credits.

Liquidity

There are efforts to build truly liquid global carbon markets. That requires pooling together similar carbon credits so that they can be widely used and traded. But since biodiversity credits are more local, pooling them together is way more difficult, if not impossible. An important note for environmental market traders.

MRV

Rather than just estimating carbon stocks, biodiversity credits are built on multiple different metrics (e.g. species abundance/richness/diversity, landscape connectivity, etc.) that all require accurate measurements. That’s why the biodiversity MRV (measurement, reporting & verification) infrastructure is more comprehensive with data coming either from field surveys or sensors (e.g. eDNA, camera traps, bioacoustic sensors, satellites, etc.), often combined with machine learning algorithms.

Implementation Costs

As a result of more extensive MRV, implementing biodiversity projects seems to be more expensive.

Aren’t carbon credits with community & biodiversity co-benefits enough?

I will only cover carbon credits that follow the CCB (Climate, Community & Biodiversity) Standards, as they focus on community and biodiversity co-benefits. Regular carbon credits, no matter the registry, are generally only concerned with doing no harm to biodiversity. That alone is a decent comparison between carbon and biodiversity credits.

Some argue that CCB credits make standalone biodiversity credits redundant. There are a couple of counterarguments to that. Firstly, biodiversity remains a second-class citizen since the main metric measured is still carbon and results are optimized to maximize the number of issued credits. Secondly, biodiversity impact measurement for CCB credits is mostly qualitative. That prevents us from quantifying the exact positive biodiversity change and valuing it accordingly. Instead of rigorous biodiversity measurement, most CCB projects rely on written causal arguments, public data and potentially some project-level manual measurements. That’s probably not enough to mobilize biodiversity finance at scale.

Community-wise, CCB credits lack one important thing - specific measurable commitments to community well-being. Apart from Plan Vivo (which is a trivial part of the voluntary carbon markets), no other large standards have committed to measurable benefit sharing, let alone credit trading royalties that go back to the community. Biodiversity credit standards have more of these commitments.

How can carbon and biodiversity credits interplay?

A couple of scenarios:

Credit stacking & bundling

Biodiversity units will either be stacked on top of carbon ones as a separate credit or bundled into a combined credit. A potentially great way to utilize the existing scale of carbon markets.

Completely separate markets

Carbon and biodiversity markets fully separate. Side effect: more complexity for buyers.

Combination of both

The most likely scenario: standalone markets develop while relying on credit stacking and bundling, at least for the near future.

Summary

Biodiversity credits are more complex but just as important: they cover a larger part of the planetary health, help avoid the carbon tunnel vision, focus more on the communities and could directly benefit nature-reliant businesses. For the foreseeable future, they are likely to remain closely tied to carbon markets though. The core difference between them remains the unit of measurement. You are what you measure.