Deep Dive: Biodiversity Credit Demand

What makes the (biodiversity credit) world go round? A little inquiry.

Hi folks 👋

For those who don’t know me, I’m Simas from Bloom Labs - a biodiversity finance newsletter & consultancy. I focus on all things biodiversity markets, nature accounting & biodiversity measurement, reporting and verification (MRV).

Cheers!

To call something a market, we need two things: 1) people who want to sell some product and 2) people who, well, want to buy it. For voluntary biodiversity markets, the buying piece of the puzzle is the elephant in the room.

I’ve been procrastinating on writing a proper piece about the biodiversity credit demand for way too long. And for the right reasons, as I soon found out. So many opinions, such a gnarly topic. Well, time to chip in.

Disclaimers

Traditionally, some disclaimers:

Firstly, I don’t have all the answers. By actually exploring the biodiversity market demand, we can end up in the philosophical debate land surprisingly quickly. Here, I’m just sharing my learnings and perspective. And this time, I optimized for “useful” and “accessible” instead of “exhaustive”. This perspective, by definition, is full of holes. I’m aware of some and probably unaware of many more. My only hope is that this work helps move the market at least one inch in the right direction.

Secondly, my focus is again largely on the voluntary market side. I will never stop repeating that regulation, litigation & public advocacy are still the biggest levers to addressing biodiversity loss though. Markets are just one tool.

And lastly, in environmental markets, mitigation hierarchy is everything. I won’t mention it much in this piece but if we don’t follow it and hold the corporates accountable, biodiversity markets will likely become a distraction instead of actually meaningful corporate nature action.

With the formalities out of the way, let’s get into it.

Setting the scene: a story in 3 acts

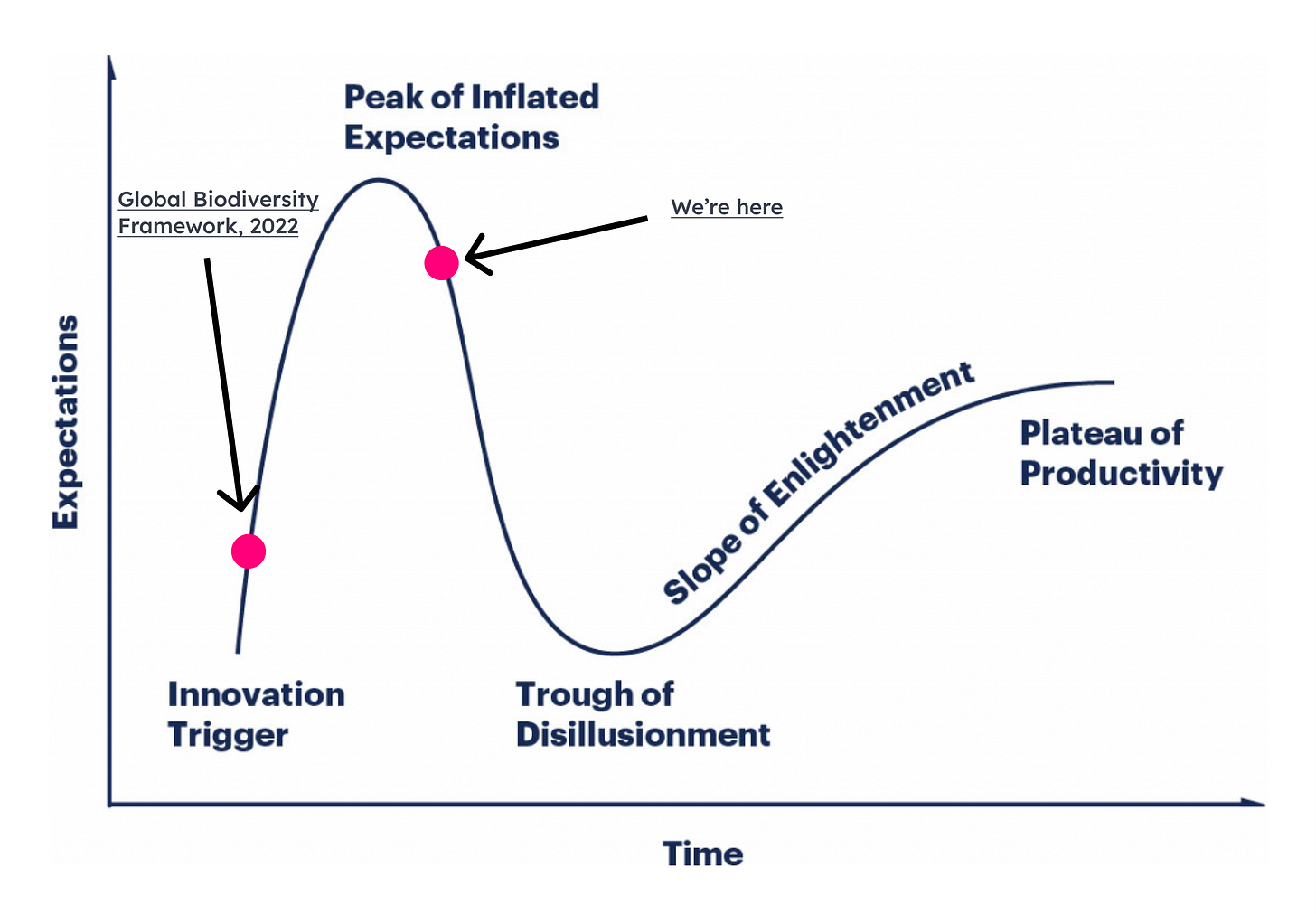

The story of the modern voluntary biodiversity markets can be summed up in 3 acts:

Act 1: Hype

Very quickly, biodiversity markets became all the rage. In 2022, the voluntary carbon market peaked aggressively. In December same year, a historic international agreement was achieved - the Global Biodiversity Framework. In a way, it was the biodiversity’s 2015 UN Paris Agreement. As with carbon, biodiversity markets had a similar promise of adding scale, speed and integrity to nature finance, if designed well. As a result, we saw a bunch of players looking at how they can create their own biodiversity credits: carbon project developers, conservation NGOs, asset managers, new biodiversity startups - you name it. As difficult as it is, it’s the easiest part of this market puzzle.

Act 2: Reality

It seemed that everyone was entering the space: supply, venture money (and their startups, offering more sophisticated market & data infrastructure), demand facilitators, best practice setters, governments. One stakeholder was missing though - buyers. Or more specifically, corporate buyers who were ready to buy now, instead of being “very interested and excited” about the upcoming market. The truth is, there were no obvious demand drivers for the corporates yet. And they won’t allocate resources and undertake any risk without obvious benefits to them.

Act 3: Present

So, where are we now? Rapid market innovation, ballooning supply and questionable demand. It feels like the biodiversity market players are figuring out something that first-time founders realize the hard way - “build it and they will come” doesn’t usually work. Lots of promise and just as many challenges.

By the way, have you noticed that I didn’t mention the Indigenous Peoples and local communities (IPs and LCs) once in this whole story? Right. Because they weren’t (and aren’t) in the driving seat of designing this market.

Challenges to scale demand

Now, I can’t go on without mentioning the most cited challenges to scaling the voluntary biodiversity market demand:

The market is too early

The buyers consider this market to be too confusing - there are still no widely accepted market rules, no unit standardization (and hence no credit price stabilization, with credits being sold from cents to thousands per unit) and no clear policy guidance.

Data problems

Biodiversity data is a big hurdle: there isn’t enough of it, it isn’t granular (read: useful) enough, it isn’t standardized and it’s often too expensive to collect.

Greenwashing fears

After multiple carbon market corporate PR nightmares, the market seemed to almost have stopped operating for a minute. Instead of learning from past mistakes of often optimizing for the purchase price and as a result buying a bunch of low-quality credits, many corporates stopped buying altogether. We could argue that this fear carried over to the biodiversity markets as well.

All seemingly legitimate challenges.

Where do we go from here?

Okay, so what are we missing? I’d say clarity and nuance (yes, I believe that both at the same time are possible - or rather, clarity is only possible with nuance here). Let me try to bring some of both.

First, I have to admit my bias. I believe that biodiversity markets (both voluntary & compliance) will grow significantly sooner or later since we just cannot ignore the economic damage of degrading our ecosystems (an unfortunately practical reason) & markets is one of the few tools we have. The question is - how well (at what integrity), how fast & how big. For “well”, “fast” & “big”, we need to ask ourselves some uncomfortable questions.

I’ll ask them from the supply side’s perspective since that’s where the majority of players (and hence challenges) are:

*What* am I selling?

*Who* am I selling to?

*Why* would they buy?

*Where* are my products applicable?

If we’re honest about the answers, we can start mapping them out visually:

See where I’m going with this? Let’s dive deeper.

The main variables

Let’s put concrete variables for these questions.

What: biodiversity credit schemes

I’ll take some of the main schemes, prioritizing those with a clearer scope and “archetypical” biodiversity credit characteristics while optimizing for general variety.

Who: buyers

Here we could separate the buyers into end buyers and speculative buyers. However, the biodiversity markets have a strong commodity market dynamic - its products (i.e. credits that represent positive biodiversity outcomes) are meant to be consumed (i.e. retired). And the speculative buyers only act as the grease to the wheels. That’s why I’ll mostly leave them out.

Corporates

The main suspect - large companies that want (or are under increasing pressure) to have both a smaller negative and a greater positive impact on nature. These are the buyers that most of the supply is implicitly building for.

Financial sector

A very diverse and important buyer type. Can be both the end buyer (e.g. banks or (re)insurers) and the speculative buyer (e.g. asset managers or traders). In my opinion, holds a lot of untapped potential.

Philanthropies

Although limited in scale, it’s the most readily available buyer. Biodiversity credits could provide more outcome-based integrity that philanthropic funds so often desire.

Governments

The most important stakeholder across the board. Besides ambitious and clear policy, the governments could also guarantee minimum demand and provide credit price floors.

Individuals

A major segment that has two levers: direct purchasing power and, more importantly, the ability to publicly pressure the corporates to take nature action.

Why: demand drivers

Regulations

For corporates, includes not only the existing or upcoming nature-related corporate financial & environmental regulations (e.g. Corporate Sustainability Reporting Directive) but also the voluntary frameworks that some anticipate will be integrated into the mandatory policies in the future (e.g. The Taskforce on Nature-related Financial Disclosures or SBTN’s Targets for Nature).

For governments, could include meeting the requirements for their National Biodiversity Strategies and Action Plans (NBSAPs), climate Nationally Determined Contributions (NDCs), and land restoration Land Degradation Neutrality (LDN) targets.

Contributions

They represent claims that contribute to the global biodiversity goals (such as Global Biodiversity Framework's "30x30" target), without equating them to any of the buyer’s negative impacts on biodiversity. Spearheaded under the “nature positive” marketing banner.

Offsetting

The black sheep of the bunch. Represents compensation claims of the buyer’s negative biodiversity impacts - just like credits in other environmental markets (e.g. carbon, water or plastic). More on them in a bit.

Public image

Includes two subcategories:

Corporate social responsibility efforts to appeal to company stakeholders, tell a good story and indirectly benefit: through increased brand value, improved talent acquisition & employee retention or the social license to operate (especially for top polluters, like mining companies).

Stakeholder pressure and company’s direct response to it. Again, involves actions to appeal to corporate’s stakeholders, especially to prevent further regulation. Could be viewed with suspicion though - regulation is almost always better for the environment (and society, especially in the long run).

Risk management

Directly related to company’s value chain. Includes two subcategories:

Supply chain risk management: especially relevant to producers with large and complex nature-dependent supply chains. Could help with the price stability of supplies, access to raw material, ecosystem service enhancement (e.g. water, pollination, soil erosion) & more. Closely related to insetting.

Product integration: especially relevant to financial institutions whose products directly depend on nature-related risks - banks & (re)insurers. Here, biodiversity credits might be integrated into their lending products or insurance policies. The deal - offering better terms to customers who achieve certain biodiversity outcomes (potentially high-integrity standardized, unitized & at scale) and hence decrease the counterparty/underwriting risk.

Product demand

Biodiversity credit integration into non-financial products. Example: bundling organic mattresses with nature restoration - for each mattress purchased, the seller commits to restoring 5m2 of the Amazon rainforest. The commercial hope is that such bundling will help the companies sell more products and sell them for more (”green premium”). Mostly relevant to the consumer-facing businesses.

Profit

Mostly the goal of the speculative buyers so far. As nature slowly moves into corporate balance sheets (check out The Landbanking Group’s vision), biodiversity credits might become a mechanism to assign a more direct and long-term monetary value here and be used by the end buyers as well.

Philanthropy

The name speaks for itself. Quantified impact is key here.

Cost of capital reduction

Related to financial nature-related risk management but especially relevant to the corporates who rely on outside financing. Examples: improved ESG credentials or meeting, let’s say, International Finance Corporation’s environmental performance standards (e.g. the biodiversity-related Performance Standard 6).

Carbon credit quality assurance

Stacking biodiversity credits on top of carbon. This should ensure robust biodiversity benefits for nature-based carbon credits - something that’s increasingly more sought after by the buyers.

Market stability

Applicable to some governments. They could ensure biodiversity credit price floors & provide regulatory clarity.

Where: geographies

Two main socio-economic (not geographic in this context) categories are:

Global North

Mostly includes the industrialized economies that have dominant geopolitical influence, few Indigenous Peoples, less than 20% of global biodiversity and clear land ownership rules.

Global South

Mostly includes the developing economies that have limited geopolitical influence, majority of world’s Indigenous Peoples, more than 80% of global biodiversity and different land ownership rules (e.g. stewardship over ownership).

End result

The below is my version of answering these questions in practice.

Clear scope is key

So here’s the moral of the story - I believe that biodiversity credit schemes should emulate startup founders more:

Know *what* you’re selling (e.g. commodity, asset or something else altogether).

Know *who* you’re selling to.

Know *how* to sell what you’re selling to who you’re selling (that’s where the commodity/asset distinction comes into play).

Know *why* the buyers are buying.

Know *where* geographically your product is best sold.

We have to be realistic: a scheme can’t expect to address, let’s say, 5+ demand drivers. At least not well and not yet. The Pareto 80/20 principle is universal and 1 or 2 demand drivers will take the lion’s share. You can’t serve everyone everywhere for every reason.

Different buyers have different motivations for buying. And a single buyer might have multiple motivations. But there’s usually one main driver. I believe that identifying it and building supply with that in mind is a big opportunity.

Now, I’m very much aware that many buyers themselves don’t know why they’d buy, apart from “philanthropic” reasons. That’s why have to push them to design their corporate nature strategies (virtually no systemic credit purchases at scale until then) & allocate more internal resources to engage with the market.

Having said that, I’m not here to criticize the schemes who don’t have much public demand clarity. We’re all making it up as we go. This is just my analysis and point of view - maybe it’ll be helpful to some. It is great to see increasingly more schemes (especially the most recent ones) putting more explicit focus on the demand side though. More and more schemes publicly define a specific buyer and demand drivers they’re building for. That’s awesome.

Thoughts

Now that the little mapping exercise is over, time to share some other related reflections:

Demand frontiers: a reality check

The “nature positive” voluntary demand is often cited as the most popular demand driver among corporates. I’m skeptical about converting it into practice though. I think it’s more of a case of corporates saying what we want to hear.

The reality is, regulation is (and will remain for the near future) the leading demand driver for biodiversity markets. Without it, the default is the commercial demand frontier - meaning companies will engage in the voluntary biodiversity market as much as they believe they’ll practically (read: commercially) benefit from. Whether that is from increased brand value, social license to operate, reduced PR/nature-related risks or any other reason.

The idea that corporates’ nature positive ideals and global goals will be the driving demand force at scale is beautiful - but probably not realistic. For that to happen, we need global structural changes: stricter environmental & financial regulations, different corporate bylaws that optimize for wider stakeholder health instead of narrow monetary shareholder value and, in the end, moving away from the GDP-centric economic point of view. Nothing less, nothing more. Exploring the geopolitical consequences of it could be its own article (or book). Until then, the voluntary demand is the commercial demand.

And I’m not encouraging to abandon the “nature positive” framing. It does have a bunch of problems (especially technical) but it does something we need more of - it inspires people to imagine and work for a better future. And that is priceless. However, I would encourage folks to focus more on the practical demand drivers - the commercial and the regulatory ones. The carrot and the stick, pulling and pushing.

We should also not take the “reasonable” corporate action boundaries that the companies themselves draw at face value. Most of them haven’t reached the pain threshold to completely rethink their business models. Hence, these boundaries will usually reflect what the corporates are willing to do within their comfort zone. Not more beyond that. For more, most have to be pushed. Or in other words, the stick leads.

Offsetting: what to make of it?

The public consensus is that offsetting is mostly forbidden in the voluntary biodiversity markets. Or so we thought. The second thoughts about it are slowly seeping from the private conversations to the public discourse. Some attempt to rebrand the claim from “offsetting” to “counterbalancing” or “taking responsibility for unmitigated biodiversity impacts”. In practice, I don’t see a difference between them.

And you can (rightfully) hate offsetting all you want. But it has one strong advantage: the buyers understand it. Offsetting solves a problem of attribution. It allows to easily estimate the damage done and, in theory, compensate for it.

Now, the public fears that allowing biodiversity offsetting in the voluntary markets will just become a license to pollute and perpetuate the status quo. If we look at the carbon markets, these fears are well-founded. There is also plenty of evidence for it in the mandatory biodiversity markets. Not to mention that technically, biodiversity offsetting is altogether impossible. You simply can’t replace a unique natural ecosystem with another, no matter what level of “equivalence” you reach.

And the final wrench to the biodiversity offsetting machine - the position of the Indigenous Peoples.

The Indigenous side

After all this context setting, time for the the actual most important topic: on-the-ground biodiversity land stewards. Local communities (LCs) are just as crucial but for the sake of the argument, this time I’ll focus specifically on the Indigenous Peoples (IPs).

The situation is pretty simple: Indigenous Peoples make up 6% of the population but safeguard 80% of world’s remaining biodiversity. In other words, they own the supply. They are systematically underrepresented & are not leading (or even co-designing) the biodiversity market development at the moment. The buyers, mostly located in the Global North, are not used to contribution claims and (at least implicitly) prefer offsetting. The issue: most Indigenous nations are strictly against offsetting & many question how such credits will integrate cultural and spiritual values, so important for them.

What’s the end game?

What is the result of this clear tension between the demand (& the pressure to integrate offsetting) and the Indigenous supply? I see two main perspectives that lead to two different outcomes:

1. Just (or idealistic)

Voluntary biodiversity offsetting is completely outlawed in the Indigenous lands and maybe even the Global North. IPs and LCs lead & co-design the market. As a result, the market is much (much?) smaller but way more stable and impactful long-term.

We should also be aware of the second-order effects here. For example, would that lead to countries in the Global South to intensify their campaigns against the Indigenous populations to recategorize what “Indigenous lands” even mean?

2. Cynical (or practical)

Biodiversity offsetting is frowned upon but not completely outlawed. As corporates set their nature strategies and start estimating how big their post mitigation hierarchy biodiversity contributions should be, they develop various internal mechanisms to do so. Overtime, it turns into implicit offsetting. Whether it is framed as “addressing potential, but hard to specify impacts via counterbalancing negative impacts with a less strict like-for-like criteria” or any other way. BioInt’s Joshua Berger & team illustrated the point very well in their biodiversity credit equivalency paper. In the end, implicit offsetting reaches global scale. The market is very large but the on-the-ground social and environmental impacts can be limited.

My heart supports the first perspective but my mind thinks that the second one is more likely. I would rather have a smaller, but more stable and higher integrity biodiversity market that wouldn’t involve regions whose stewards are against the way the market is handled.

Limits of biodiversity markets

Although I found my footing in the nature finance space through exploring biodiversity markets, I’ll be the first to admit that it is just one of the tools we can use to fund nature. Global Canopy published a great review of many other nature funding mechanisms. There are even more.

That’s why I have to mention just a couple of limits of this shiny new “biodiversity markets” tool:

Regulations first

I won’t get tired of repeating it - environmental voluntary markets can be a flexible and fast mechanism for moving money to the right places but it can never replace environmental regulations. Assuming otherwise is risky.

Limits to corporate nature-related risk management

When the focus point is a specific ecosystem service in a company’s value chain, direct interventions or other custom solutions are probably more effective than biodiversity credits.

Limited cost-effectiveness

High-integrity, flexible, (somewhat) standardized and scalable funding mechanisms have their costs. Intermediaries (e.g. credit schemes, auditors, data providers, marketplaces & more) all demand their own cut. As a result, many projects are bound to be too small to be economically effective, especially considering how important fair benefit sharing here is.

Main takeaways

What was supposed to be a quick illustration of a perspective became my longest article yet. And it could’ve easily been twice as long.

If there’s anything I’d like you to take away from this deep dive, it’s this:

Product focus is key

Biodiversity credit schemes should be built with the end buyer (ideally single, at first) in mind from the start. And together with IPs and LCs, of course. That can slow down the market entry but the fruits of this labor should be worth it.

Indigenous perspective

Practically speaking, the Indigenous Peoples hold the supply. They should make the market rules, will all the consequences of it.

We have two demand frontiers to push

Mandatory and commercial (or as we like to call it, voluntary). Both at the same time.

Thanks for reading!

Thanks for sharing your perspective, Simas! You hit the nail on the head with your emphasis on the critical need to collaborate with Indigenous Peoples. But I can also say from an asset manager’s ESG perspective, the bad rep around carbon offsetting really has a knock-on effect on the biodiversity credit market. It’s the fear of greenwashing accusations together with a broader lack of understanding what such credits can actually achieve, that is holding many asset managers back at the moment to embrace the biodiversity market (coupled with other drivers like the anti-ESG backlash in the U.S that got many asset managers being more cautious in launching new ESG initiatives). I also agree that regulation will be a key driver to moving the needle in this space, but I’m curious to hear your perspective, Simas, on the TNFD framework. As increasingly firms are committing to adopt the TNFD framework early, do you see this as a potential catalyst for the voluntary biodiversity credit market?