Deep Dive: Biodiversity Credit Schemes | Part 2

An in-depth exploration of the biodiversity credit scheme landscape: thoughts and opinions

Hi folks 👋

For those who don’t know me, I’m Simas from Bloom Labs - a biodiversity finance newsletter & consultancy. I focus on all things biodiversity markets, nature accounting & biodiversity measurement, reporting and verification (MRV).

Cheers!

This is part two of the biodiversity credit schemes deep dive. In the first part, I open sourced a detailed spreadsheet of every single biodiversity credit scheme I could find & shared some general observations.

This time, I’m sharing more personal thoughts and opinions on the space: the hopes, concerns, challenges - you name it.

Disclaimer: biodiversity markets is not the answer to solving the biodiversity loss crisis. It is just one of the tools in the toolkit and it happens to have a lot of potential (like markets do, both for the positive and for the negative).

Thoughts on the Present

Again, governments should probably run the show in nature finance

Private market innovation is usually faster, but considering the urgency of the biodiversity loss and climate crisis, it’s becoming clear that nature finance should be spearheaded by governments. There’s a lot to be done: designing ambitious regulations (e.g. EU’s Nature Restoration Law), kicking off new national well-functioning biodiversity markets, integrating nature & communities into financial accounting, and more. It would likely also help to scale up the private markets faster (and probably at higher quality).

Ideally, we wouldn’t only have nature-related financial disclosures - we would also have legal obligations to decrease the impact on nature and contribute to protecting & restoring it. The reason - most companies tend to react only when they are incentivized or forced to. Considering the timeline, soft stakeholder pressure is not good enough. That is what we’re seeing now. The forward-looking companies that are actively engaging with nature-related topics will probably be the ones reaping the most business benefits as well.

Ability to assess credit quality is key

In environmental markets, probably the most important factor is credibility. We’re pricing assets that are not easily graspable and if the buyers can’t trust that the credits represent genuine positive impact on biodiversity, the whole thing falls apart.

Having gone through all the biodiversity credit standards I could gather, here are some high-level signals of quality I found:

Scientific rigor

Likely the most important *and* the toughest to assess. Many biodiversity methodologies are deeply technical and there aren’t many people in the space who can truly fully understand them. And even if they do, there is a lot of disagreement between the top standard developers on which is the way to go. In any case, the historical pain points around setting baselines, additionality, permanence, leakage & more have to be addressed well.

Community focus

The best schemes explicitly focus on the well-being of communities on whose land the projects are developed. To take care of nature, the land stewards must be taken care of first - something that they’ve historically been great at themselves before the global economy growth pressures settled in. Standard co-design, community buy-in, operational involvement, benefit sharing and more are essential.

Open source methodology

Publicly sharing as much as possible about the standard brings trust. I understand the IP-related concerns that some standard developers might have but if the public can’t verify that the biodiversity protocol is sound, how can the credits that are issued using it be fully trusted?

Sophisticated MRV

Well-designed, tech-first measurement, reporting and verification (MRV) can make data collection and usage cheaper, faster & better. As hyped as this space is, I’d like to see more focus on it in most of the schemes.

3rd party auditing

There’s a split between self-certified/verified schemes and schemes audited by 3rd parties. From an integrity perspective, the latter is obviously more desirable. Although it is more expensive and hence less accessible. Ideally, on-chain MRV would make 3rd party auditing way cheaper or even obsolete (if at all possible).

A split between the standard and project developer

Ideally, the biodiversity credit standard developer and the project developer using the standard is not the same party. Otherwise, we’re facing a potential conflict of interest - the standard developer is incentivized to inflate the number of credits that can be issued since their compensation is directly tied to it.

One counterargument here is that at such an early stage, it’s very difficult to develop projects according to an existing biodiversity credit scheme. That’s why often, the project developer ends up creating a separate standard themselves.

We have to find a better way to connect the biodiversity damage with biodiversity contributions

Since biodiversity damage fundamentally cannot be offset, we end up in a peculiar position - how can we estimate how much a company should contribute to nature to (sorry for saying this, ecologists) “neutralize” its biodiversity impact, considering it followed the mitigation hierarchy?

To scale the biodiversity market further, we must understand the (more quantified) impacts that businesses have on nature. As always, it goes back to nature accounting - if we can map the company’s biodiversity impacts, risks and dependencies, we might be able to give a more accurate guidance on how much resources the company should contribute to nature preservation and restoration. This gets murky fast because it sounds awfully similar to offsetting. Thankfully, frameworks like SBTN’s science-based targets for nature should help in setting standards around assessing companies’ nature & biodiversity footprint and then setting targets to decrease it while Taskforce on Nature-related Financial Disclosures (TNFD) will help companies map out and disclose their nature-related impacts, risks and dependencies.

In the end, if we can clearly link nature-positive investments with, for example, the increased resilience of businesses’ supply chains, we would have a way more tangible reason for them to invest into nature. It would become a business-critical activity then.

Credit tradability is vital to reach scale

Some want biodiversity credits to be untradable and only be used for contributing to positive biodiversity activities/outcomes. Others promote tradability to offer an opportunity for secondary market players to make money. Ultimately, to reach the scale we probably need both. Otherwise, without tradability, it’s hard to imagine large brokers and asset managers engaging at any meaningful scale.

But the foundational demand layer must be built by purchases designed to contribute to nature or increase business resilience rather than to make money via speculation. Corporates and governments should ensure base level demand for the credits.

It would:

Allow the market to properly kick off (since the biodiversity credits will have tangible value because of the guaranteed public & private demand, whether voluntary or driven by regulations).

Allow return-seeking investors to use that foundational demand to scale the market multifold.

I should point out one thing - conserving nature is not the same as just utilizing it and persistent double digit returns should not be expected (to be frank, they were never sustainable to begin with). Ideally, the biodiversity markets should *not* be driven primarily by speculation.

Stackable credits are difficult

Stacking biodiversity credits on top of carbon units or bundling them into one is a promising way to scale biodiversity finance since it’s basically plugging into the existing voluntary carbon market. It might allow skipping years (that we don’t have) of the initial slow market development.

Although it’s not without potential risks - not designed well, stacking and bundling could introduce additionality (that Sophus zu Ermgassen illustrates well here) and additional market complexity risks. And since there are still no clear rules around how to stack and bundle these credits, investors remain cautious.

Like I mentioned in the past article, I believe that biodiversity credits have a space of its own. Stacking and/or bundling with carbon credits can be a good transitory step to achieving that.

Trading royalties seem unrealistic

I understand (and love) the thought behind introducing trading royalties designed to benefit the local communities but I haven’t yet heard a convincing argument on why the return-seeking investors and traders would give up 10-50%+ of their profits on each profitable trade. Really hope I do hear one.

Compliance markets need much improvement

There’s a lot of accelerating movement in the biodiversity market compliance schemes (e.g. UK’s Biodiversity Net Gain, UK-French biodiversity credits roadmap, Australian Nature Repair Market, New Zealand’s national biodiversity market). Understandably, these schemes are incredibly complex. And it shows - all of them face design-level criticisms (e.g. integrity, transparency, market design, MRV, etc.) that the governments should address before launching them.

I wish there were more marine schemes

Marine biodiversity quantification is unsurprisingly harder than the terrestrial one and we can see it in the upcoming schemes - only three out of 30+ are solely focused on marine conservation. And these three do not seem close to maturity. Obviously, open waters are vital to healthy ecosystems and, as difficult as it is, should receive more attention, especially from the governments.

We should have tolerance for early biodiversity market failures

Mistakes are bound to happen - it’s part of the early iterations. The demand side should accept that and engage with the early biodiversity standards in good faith. And, in turn, we should have tolerance for the early buyers as well. Greenwashing risk is keeping many companies on the sidelines and the best we could do is change the narrative: the initial buyers should be viewed as somewhat bold early adopters, not ill-informed corporates that are blindly walking into another scandal.

Thoughts on the Future

Long-term, on-chain will win

Credibility in the environmental markets is crucial and the blockchain systems just happen to be designed for it. If credit origination is transparent and accessible via on-chain MRV, credits are easily transactable via on-chain markets (with custom KYC & other restrictions built in if needed) and auditing/certification done openly on-chain, we’re in a good position to have global scalable biodiversity markets. Although we can only reach the largest scale if the credits are fungible - something that is questionable for biodiversity markets.

Long-term, open source will win

Again, when it comes to environmental assets, trust is everything. Hence, doing anything that would increase it should help with the overall market adoption, including open sourcing your methodology and any other material.

Schemes will have to become more simple to understand

Methodologies must become easier to understand and implement without sacrificing scientific rigor and integrity - a tough one. At the moment, our hopes are pinned on technology and standardization: better & cheaper MRV tech, improved/standardized biodiversity quantification & unitization and improved certification & auditing processes.

Who will dominate the future?

Will the biodiversity markets be also dominated by the top carbon registries (i.e. Verra, Gold Standard, Plan Vivo)? Although I understand why more consistency and standardization is critical for both buyers and sellers, incumbent registries launching their own standalone biodiversity standards may stifle innovation - something none of us want.

Ideally, the best biodiversity credit schemes would be integrated into these registries, without the registries trying to reinvent the wheel themselves. Thankfully, we’re seeing early signs of such consolidation with Wallacea Trust and then Pivotal collaborating with Plan Vivo. That’s likely the optimal combination of speed and scale.

I’m also hoping that the new players, like the on-chain native Regen Registry, will carve out a space for themselves. More competition among the registries is definitely welcome.

Challenges

For this piece, I’m not including things like baseline, permanence, leakage or additionality - they definitely remain challenging but they’ve been covered well enough in the context of carbon markets. I’ll only expand on a couple of challenges more exclusive to the biodiversity markets.

Standardization

It’s probably the most discussed hurdle to scaling biodiversity markets. To show you how deep it goes, let me list out just *some* parameters that could use more standardization:

Methodology type

Practice-based and outcome-based methodology types are like two different schools of thought. The former is more focused on the inputs, the latter - on the outputs. Although both make sense (especially in different contexts), choosing one or the other dominates the further credit scheme design.

Credit unit

We’re seeing three different types of credit units emerge: habitat-based, species-based and ecosystem integrity-based, with sometimes stark differences within each type (h/t to Edit Kiss who identified these categories earlier). On top of that, the credits represent different preservation/restoration timescales: from a year to indefinite, most landing between 10 and 50 years.

MRV

MRV sophistication varies from manual field surveys to utilizing the most cutting-edge monitoring tech. Ideally, we’d use technology wherever possible, without cutting down on meaningful community engagement.

Credit issuance

The credits are split between being issued ex-ante (forecasted) and ex-post (post verification/milestone).

Tradability

Even though the majority of biodiversity credit schemes support credit trading, there is still no widely-accepted consensus here.

Benefit sharing

Even though some pioneering schemes heavily support *explicit* benefit sharing (e.g. ValueNature, Wallacea Trust, Wilderlands), it is still not the consensus in the space.

Credit stacking

Again, most schemes do not (at least publicly) support credit stacking but some major ones do (e.g. Wallacea Trust).

Now, with all that in mind, imagine effectively pricing or pooling biodiversity credits while also considering that standardization doesn’t guarantee quality. We have a lot of work to do here.

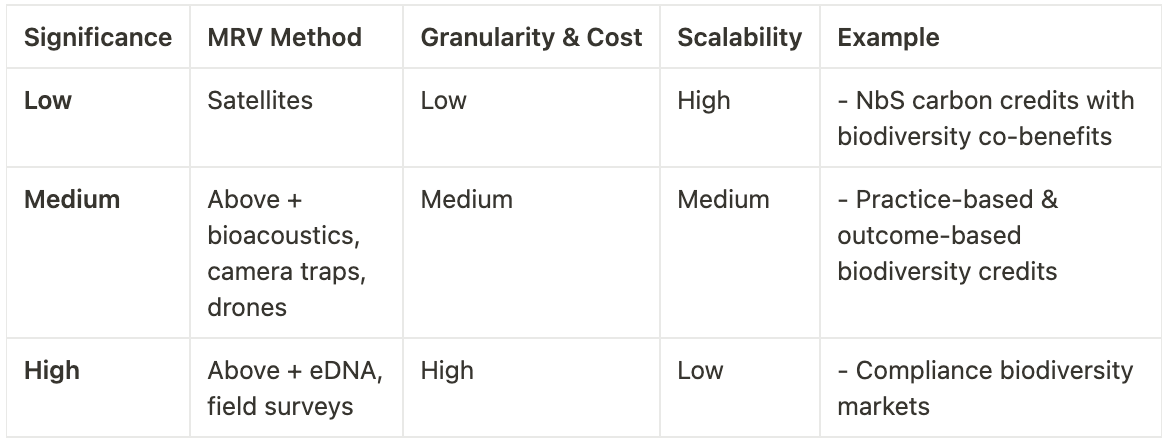

MRV: the tension between scale and granularity

Highly scalable data (e.g. satellites) is relatively cheap but not very granular. Highly granular data (e.g. eDNA) is relatively expensive but not very scalable. One of the ideas to solve this tension is adding more context for each credit type and using a tiered MRV approach according to significance.

For example, it could look something like this:

Summary

Two things are obvious - we’re super early and biodiversity credits hold enormous system-shifting potential to preserve and restore biodiversity. We’ve got our hands full. The good part - we’re progressing & improving at an accelerating pace, which will lead to more (public) biodiversity credit transactions. There’s so much to be excited about in this space.

Interesting read tks!

“without tradability, it’s hard to imagine large brokers and asset managers engaging at any meaningful scale.” Why are speculators necessary to scale the market for biodiversity projects?

With different units of credit and a variety of different measurement methodologies how is the $ value of any given credit established?