Deep Dive: Marine Credit Schemes

An analysis of marine (biodiversity, carbon, plastic & nutrient) credit schemes 🌊

Hi folks 👋

For those who don’t know me, I’m Simas from Bloom Labs - a biodiversity finance newsletter & consultancy. I focus on all things biodiversity markets, nature accounting & biodiversity measurement, reporting and verification (MRV).

Cheers!

Nature finance is (finally) a hot topic. Unsurprisingly, the terrestrial ecosystems received most of the attention though. In this piece, I want to honor the systematically underfunded but absolutely vital coastal & marine ecosystems. That’s why I went through every single marine-related environmental credit scheme I could find and, just like before, made an in-depth list of each. Spoiler alert: there are already 20+ schemes out there.

Disclaimers

Similar to my biodiversity credit list, a couple of disclaimers beforehand:

Firstly, I mostly focused on voluntary schemes. There are more compliance schemes that, in theory, cover marine finance but either they’re still very early or too complex for today’s scope.

Secondly, this is a simplified overview. Details and context matter - it is obviously impossible to boil down all the marine credit finance action into a spreadsheet.

And thirdly, it’s likely that not everything on the list is 100% accurate. I tried my best to only add verified information but it does include some educated guesses and opinions - a result of limited information available.

If you think I missed anything important, definitely let me know. I’ll do my best to keep this spreadsheet as a living organism that reflects the marine credit space.

Overview

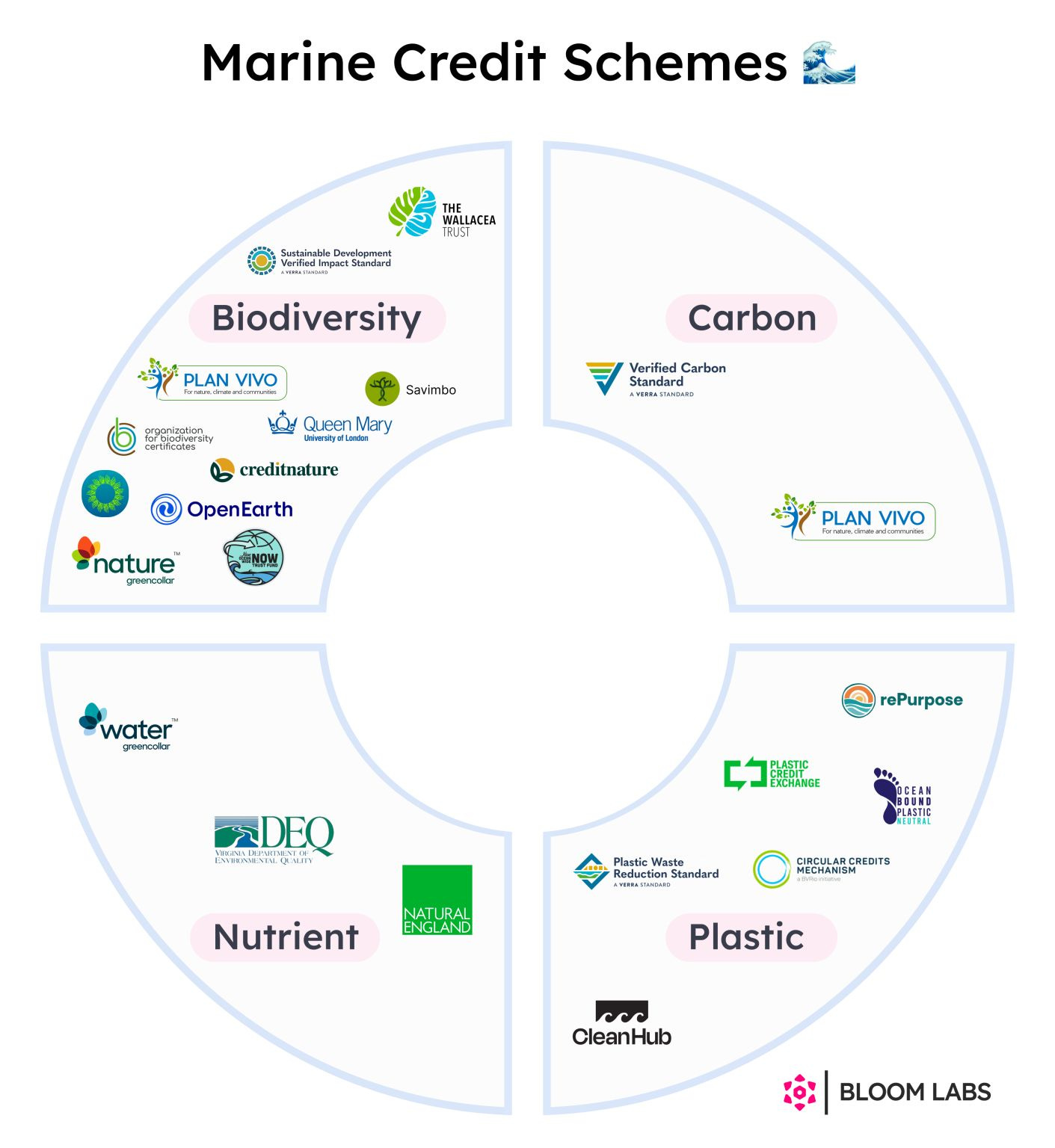

Generally, there are 4 types of marine credits: biodiversity, carbon, plastic & nutrient. Blue carbon and nutrient schemes are the most developed ones but biodiversity & plastic are experiencing rapid growth right now. All these credit types share the same operational base, mostly inspired by carbon credits.

Biodiversity

Most direct marine life finance

Unsurprisingly, biodiversity credits contribute to marine life most directly. In the end, although all of these schemes help support life in the oceans, biodiversity credits are the ones measuring that life.

The earliest & most complex of them all

Environmental markets have layers of complexity. Carbon markets are already complex enough, even though they have the advantage of having a global & globally accepted (2 different but crucial characteristics) unit of measurement. “Marine” and “biodiversity” are two additional layers of complexity. No wonder why marine biodiversity markets are the least developed out of all marine finance credit schemes. A lot of research, standardization & international cooperation to be done here.

There are no major marine-first credit schemes

All major biodiversity credit initiatives start with the terrestrial ecosystems. Many of them claim being applicable for the marine ecosystems as well (I wonder how many marine biologists would agree with that..). I’m pretty sure the remaining terrestrial schemes will also try to enter the marine markets sooner or later.

The only schemes that are marine-first are being built by smaller players & are either highly simplified (e.g. Niue Ocean Wide Trust) or still at very early stages (e.g. Open Earth Foundation or NewAtlantis Labs) and seemingly slow pace.

Majority of schemes haven’t yet launched

And the launched ones are super recent. The earliest marine-applicable scheme that launched was the Wallacea Trust, back in 2022. And many could argue if piloting multiple projects is considered launching.

Voluntary schemes rule

For now, the marine compliance market action is limited. I’m keeping my eyes peeled for Marine Net Gain in England though.

There are still very few pilot projects

Solent Seascape Project is the only publicly shared project I could find. I’m pretty sure there are quite some other projects being piloted among other major schemes (e.g. Verra, Wallacea Trust or GreenCollar) though.

Carbon

The most established category

With a 25+ year history, carbon credits are undoubtedly the most mature voluntary marine finance credit class. Supply, demand & clear differentiation between standard makers, project developers and technology (MRV) providers are all in place - something that’s not yet the case for other marine finance credit categories.

Verra is the 800-pound gorilla

Although I wasn’t able to dig up accurate numbers, volume-wise, Verra’s blue carbon credits clearly dominate the market. As in any markets, such influence is usually unhealthy and doesn’t incentivize best behavior.

Blue carbon is on the rise

Historically underlooked, blue carbon markets are booming. By all accounts, the market is suffering from a strong demand and limited high-quality supply. And since it can utilize the established carbon market rails, the market is likely to scale fast & reach the widely advertised billion dollar revenue mark sooner rather than later. The standardization & wider acceptance of some of the coastal sequestration models (i.e. mangroves, seagrass, saltmarshes and now also kelp) is helpful as well.

Plastic

For the newcomers, plastic credits is a voluntary market mechanism for plastic waste management. Like most other environmental credits, it was inspired by the carbon markets. Hence, it’s structurally similar - both in scope (i.e. project development, baseline & additionality proofs, etc.) and market structure (i.e. credit schemes, project developers, marketplaces & corporate buyers). It rewards additional plastic waste management activities (e.g. collection, sorting, recycling, disposal or avoidance) in areas where public waste management infrastructure is still inadequate. Here, I’ll focus on schemes that are closely or directly related to ocean bound plastic - a huge and growing challenge.

Extended Producer Responsibility (EPR) is king

EPR is a policy approach where producers take responsibility for the disposal of products they produce. It’s widely adopted in most of the “developed” world. Not so much in the “developing” world yet. Plastic credits come in to fill that institutional gap. Although EPR is the preferred choice of waste management, implementing plastic credit schemes is usually faster (and we don’t have time to waste). That’s where potentially the most unique characteristic of plastic credit markets come in: in theory, they are designed to be temporary, until EPR is adopted in most jurisdictions. Some even claim that plastic credits can help accelerate the adoption of best EPR schemes. Let’s see.

Plastic credits: somewhere between carbon and biodiversity

Researching the plastic market left me with an impression that it is somewhere between carbon and biodiversity - both in market dynamics and maturity. They are local but not as local as biodiversity, tradable but not as tradable as carbon, used for contributory claims but not as much as biodiversity, mature but not as mature as carbon. Rough middle.

Plastic credit value chain is still forming

Just like in biodiversity markets, the plastic market value chain is not yet neatly separated by each stakeholder. Some operate in multiple fields (e.g. scheme, project developer, certifier).

Offsetting: structurally possible but controversial

Offsetting is not always allowed but since there is a natural equivalence/commensurability (weight of plastic waste produced vs weight of plastic waste managed), buyers can claim benefits without claiming that they’ve “fully offset” their negative impact. And since plastic pollution & management is theoretically simple, many claims can be made. Room for caution.

Additionality is an especially sticky issue

The fact that the informal waste sector workers are doing precious work does not mean that they work in good conditions, are well-paid or enjoy their jobs (to be clear: it usually means the opposite, especially for the first two). Maybe they would continue doing this work anyway but does that mean that using plastic credits to improve their work conditions, increase their salaries and help them have dignity in their work is not technically additional? It’s an uncomfortable conversation.

Nutrient

Nutrient credits standardize the reduction or avoidance of freshwater (or sometimes coastal) nutrient pollution, eventually benefiting the oceans. They are some of the earliest environmental (pollution) markets here, tracing their origins in the 1980s. I’ve only added a couple of the most well-known nutrient credit schemes to illustrate the point. There are multiple other initiatives running across Europe & US.

Strong compliance market presence

Among all four credit types, nutrient credits are the most likely ones to be compliance based. Water quality standards have been regulated for some time now and most polluting materials are well established (e.g. nitrogen, phosphorus & sediment). That makes it easier to establish functioning local credit trading schemes.

Nutrient credits work

Not many know much about nutrient trading schemes but they can be very efficient. The Virginia Nutrient Banking Program and GreenCollar’s Reef Credit Scheme are probably the most noteworthy examples. American wetland restoration is a multi-billion industry and nutrient credits play a big part here. Strong regulatory background and (relatively) straightforward monitoring are big reasons for that. Although in the international context, we haven’t yet seen a widely successful nutrient trading scheme. There were some recent attempts to do so in the Central Baltic, with limited success.

We can learn a lot from nutrient credits

Although voluntary markets are all the rage, nutrient trading schemes can inform the other marine-related credit markets. Standardized MRV and strong regulatory support is key. Showing direct business benefits of financing marine ecosystems is crucial but we can’t rely on businesses to start paying for services that were rendered for free before. That’s why regulatory support is important in every single voluntary market (which makes the difference between voluntary and compliance markets even more fuzzy).

General Observations

Disclaimer: I allowed myself to be a little “unfiltered” in this section.

Marine-first credit schemes: are they even possible?

As mentioned earlier, there are no major marine-first credit schemes. That makes me think:

Do they even make sense?

I’ll be frank - I don’t yet know. I’m sure many marine biologists would say so but is confusing the market with even more (biodiversity) credit schemes worth it if there are terrestrial-first approaches that would work well in the oceans? Obviously, that is not yet validated at scale. One thing is certain though - we need market unity (i.e. common biodiversity unit, stable pricing, mainstream financial system adoption) and we need it yesterday.

The majority of the ocean pollution starts inland

That is true for plastic and (mostly) nutrient pollution but a strong case could also be made for both carbon and biodiversity credits. People live on land and tackling our consumption patterns is at the core of why environmental credits even exist.

Single species marine biodiversity schemes: elegance

Schemes focused on single species can afford to be way more elegant, structurally. For example, Savimbo focuses on observing indicator species that represent intact ecosystems. That removes the need of accurately quantifying the ecosystems while still preserving them. I’m curious how this model will perform in the marine space. The terrestrial results have been promising so far. Similar logic applies to the Biodiversity Impact Credit scheme, led by Dr. Axel Rossberg from the Queen Mary University of London. It’s designed to mitigate species extinction and is only focused on increasing the global abundance of that one species. Niche but very promising if appropriate indicator species are selected.

Let’s embrace (marine) biodiversity complexity

That brings me to another topic: the complexity of nature and our (hopeless) desire to understand and control it. It’s inspired by reading too many research papers that spend years mapping out a small piece of nature without truly connecting it across ecological boundaries & then making scientific claims on biodiversity gain. It’s as if we’re trying to pinpoint the nature of nature with eye blinders.

We don’t need to accurately model every square (kilo)meter of our coastal & marine ecosystems to conserve them. I refuse to accept that research & data gap is the main bottleneck. Don’t get me wrong, it is crucial. But lack of regulatory pressure & clarity is the main bottleneck. Lack of will is the main bottleneck. We might never have perfectly modeled marine biodiversity data but it doesn’t mean that we don’t know how to protect our oceans. We need to have the uncomfortable conversations on public & private resource allocation. We need to have the uncomfortable conversations about unsustainable consumption of ocean resources. Data will help but it’s not everything. Under the current system, I no longer believe that businesses will proactively conserve nature unless they identify a clear commercial benefit, let alone in open waters. That’s an important challenge we need to tackle, next to firm regulations. Carrot and a stick.

Environmental market pillars: local community focus & transparency

What matters in environmental markets the most? That’s the question I asked myself virtually every day for the past year. Two (systemic) things solidified: local community focus and transparency.

Here’s a public secret - without improving the lives of communities who rely on the ecosystems in the project area, we can forget about long-term project success (to finance folks: no permanence). IP and/or LC-driven scheme design, technical accessibility, codified benefit sharing rules, credit trading royalties, accessible payment systems - all of these really matter.

Secondly - transparency. As much credit project information as reasonably possible should be open sourced: from sampling design, reference regions selected, maps used (ideally peer-reviewed), project area categorizations to project ownership or actual credit transactions. Technology can also help: verifiable real-time sensor usage for project monitoring and transparent transactions using blockchain at a methodology level can be very valuable. Plan Vivo’s collaboration with Pivotal for their PV Nature standard is a great example of that (although it’s not the most technically accessible scheme).

Without these two, that’s where the age-old problems like faulty baselines, additionality, permanence, leakage or fair benefit sharing creep in, in my experience.

Quantity ≠ volume

Although you see only two carbon credit schemes with blue carbon methodologies here, Verra’s blue carbon volume alone is likely larger than all of the biodiversity credit schemes combined (for now).

Schemes are dominated by the English-speaking nations

Out of 22 schemes, 16 are from English-speaking countries. That’s probably a result of their historical leadership in developing new markets & my implicit bias for English-speaking markets.

MRV highly varies

Data collection and reporting/verification significantly differs between different credit types. Carbon projects historically rely on carbon stock modeling, remote sensing and field measurements. Biodiversity projects take it up a notch by integrating new sensor tech like bioacoustics, camera traps & eDNA on top. Plastic projects are completely different though. They are built around supply chain traceability records like invoices & receipts next to weight measurements (although new players like CleanHub are utilizing computer vision to streamline the process). Nutrient projects, on the other hand, depend on (usually manual) water quality monitoring and well-established modeling.

Outcome-based credits rule

There’s implicit pressure to issue credits only for verified outcomes. That’s become the status quo across all credit classes.

In the early market development stage, it’s difficult to avoid conflict of interest

Usually, environmental markets are built around the non-profit registries (e.g. Verra or Gold Standard). Their purpose is to assure credit project quality and manage different credit schemes. Biodiversity and plastic marine markets are shaping up to be similar but the stakeholders are not yet neatly aligned. Many schemes are built not only by the registries but also the for-profit organizations who do project development - a potential conflict of interest. At such an early stage though, it’s extremely difficult to kick off a market any other way. Someone has to build the infrastructure for the market to scale and it rarely is multiple different players working in tandem. I’m wondering if targeted regulation could be helpful here.

Final Thoughts

Oceans have long been taken for granted. We’re finally at the point where various different marine ecosystems are collapsing in front of us, which reminds us how dependent we are on them. We’re seeing the perfect storm environmentally, technologically & politically that I believe will lead us to truly value our oceans, sooner or later. Two solution paths folks usually see is the public and the private.

The public side remains the biggest lever for marine ecosystems. There’s so much international cooperation required. I hope we can build on the historical High Seas Treaty here.

On the private side, we’re finally seeing enough financial damage for companies to care. And thankfully, we’re now equipped with solid (enough) science and operational tech (IoT & blockchain) to value these ecosystems in real-time. This is the place where well-designed environmental markets can shine at scale.

One last thought: the nature-based solutions is basically an effort to integrate nature into our financial system. To internalize the externalities. Few publicly talk about the consequences of that. One is undeniable - higher (or rather true) price of products and services. The second order effects are likely increased inequality (if not regulated) and reduced consumption. Unfortunately, economic dominance is currently achieved by increasing both the scale and speed of production and consumption. And international competition between different alliances doesn’t help either. I am hopelessly optimistic but I wish we would start having more open-ended conversations here.

Here’s the link to the spreadsheet of the marine finance credit schemes.

Superb work once again. Doing the grafting so we can all stay up to date with everyone going on.

Cheers Simas!