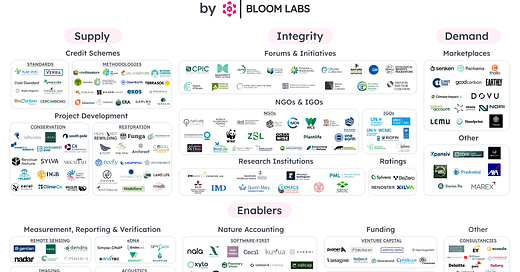

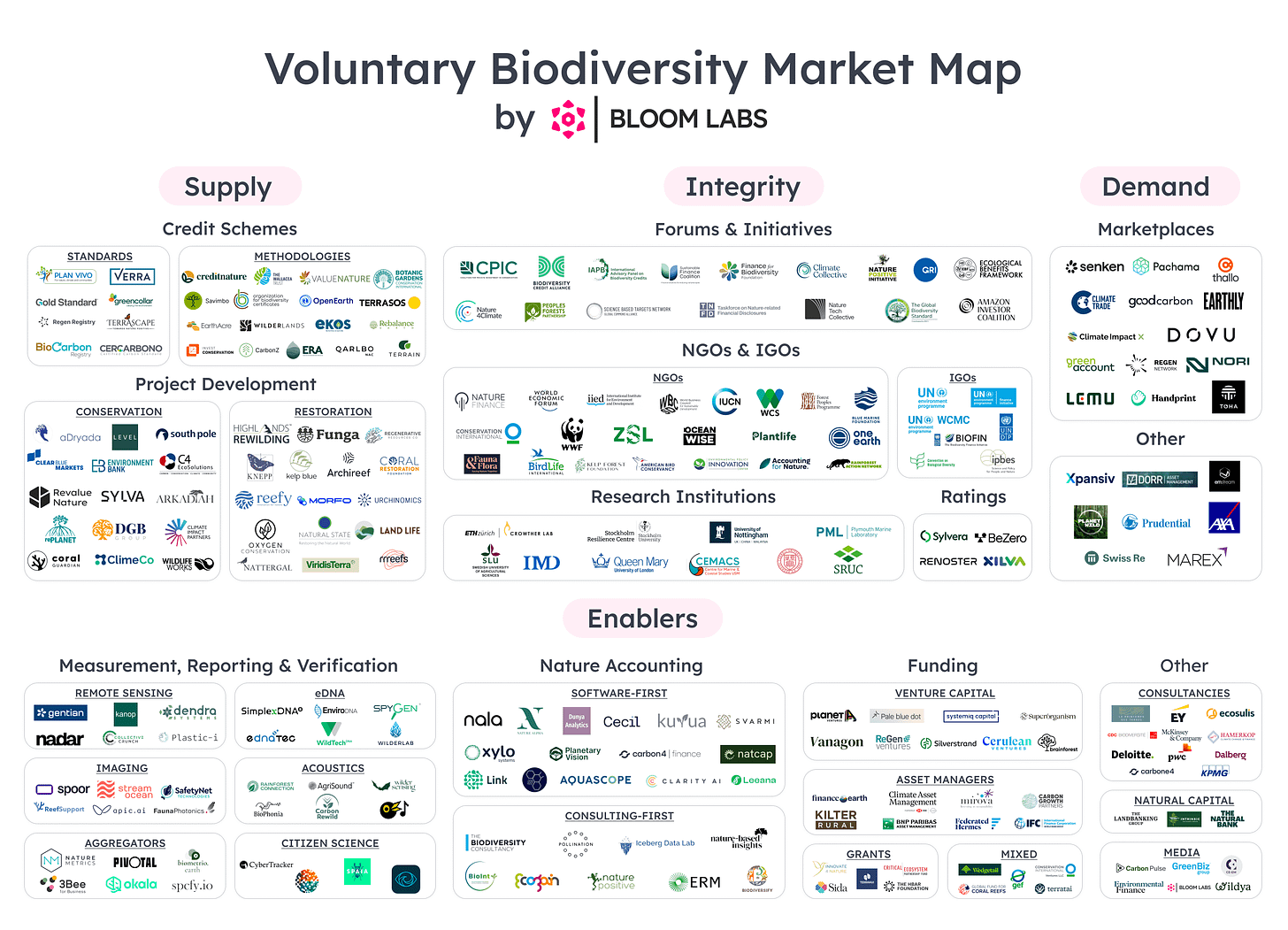

Voluntary Biodiversity Market Player Database (450+ of them) 📚

Do you want to access VBM in a granularity not available before? Read on.

I wanted to list out every voluntary biodiversity market (VBM) player for a long time. Initially I thought how hard can it be. There won’t be more than 200 of them anyway, right? Sure. 🙂

Months later, I can finally share with you an extensive database of every organization involved in the voluntary biodiversity market I could reasonably find (more than 450!), in scope and granularity at least I haven’t seen before.

This is a subscriber-only special. To access the database, you must first subscribe to the newsletter. You'll then get the Airtable link in the welcome email. For the existing subscribers, you’ll find the link in the original newsletter in your inbox.

❗️But first, for those who don’t know, I also run a consultancy at Bloom Labs. There, I basically handhold organizations who want to understand biodiversity markets better. That can either be a one-off walkthrough, longer-term advice or even custom research. If you’re curious about exploring biodiversity markets, feel free to ping me & book an intro call at simas@bloomlabs.earth.

I also suggest watching this quick video walkthrough on how to best utilize the database for your own research.

And lastly, if you don’t see your org in the database, just fill in this form!

In this piece, I’ll provide more context around how I compiled this dataset. I really recommend you going through it before spending more time on the database itself.

Let’s dig in.

Disclaimers

Before I start, here’s a block of disclaimers (to hopefully answer many of the initial questions):

1. The scope is VBM-only

The specific scope of this database is the voluntary biodiversity market. Not the biodiversity startup scene and definitely not the nature tech ecosystem. I’m pretty sure I could easily list 1,000+ solid nature tech organizations. VBM is just a subset of it.

2. Not every player is listed & not everything is correct

There’s no way I’m even close to listing every player in the space. There are bound to be some categorization mistakes as well (since many organizations operate across categories). It should help folks understand a bigger picture (& more) though. I’m also blinded by my Western-centric selection bias. I’m sure I missed many amazing organizations from the non-English-speaking world.

You can find the criteria for making it into the database I used below.

3. Many of the most important stakeholders are structurally invisible

Crucial players like Indigenous Peoples, local communities or smallholders are left invisible by the format of the list. I tried to add as many organizations representing them as I could. They rarely operate under a logo or have the opportunity to engage with the market though. Room for improvement for all of us.

4. The carbon vs biodiversity line is thin

This thin line requires some subjectivity. Many carbon players are privately gearing to enter the biodiversity space. I tried to pick only those that have already done so, have shared to be planning to do so or it’s just too obvious to me that they’ll do so soon.

5. I didn’t include many MRV providers

Related to the previous point, it can be difficult to categorize some measurement, reporting & verification (MRV) providers since they can often offer their tech for carbon, biodiversity or any other market. I’m especially referring to the hundreds of remote sensing companies here.

6. No banks or corporates

I avoided adding them because if things go right, most of them will be part of the market anyway. It’s too much noise to add them for now though. The only exception I made was for a couple of large insurers who’ve been very involved in developing VBM over the past years.

7. I missed many public organizations

IGOs, NGOs, alliances, governmental organizations - you name it. Many of them do so many things and often engage in topics through large multi-stakeholder collaborations. That can make it very difficult to reflect their work in a spreadsheet. I do acknowledge that they are some of the key players on whose shoulders the market sits.

8. My assumption for conservation NGOs

I’m assuming that many conservation NGOs who’ve been running conservation projects for years could be considered biodiversity credit project developers as well. All that’s required is repackaging their work.

Phew, light start. If you do see gross inaccuracies in the database or know any organization that you think must be included here, just ping me.

Categorization context

Scope

Here are the criteria I used to decide if an organization should be included in the database:

Organization explicitly operates in the VBM.

Organization publishes opinions and research on VBM or is (in)directly involved in such content being published.

Organization is strategically very close to VBM (e.g. some voluntary carbon market players) & is very likely to enter the market soon.

Organization is actively exploring VBM, publicly or privately.

It is reasonable to assume that the organization will move into VBM soon.

Category definitions

Here are some of the category definitions worth outlining. Not all of them follow the perfect cookie-cutter industry guidelines.

Categories

Credit Scheme

An organization that is developing different biodiversity credit systems (e.g. standards, frameworks, methodologies, programs).

Project Development

An organization that develops or is planning to develop biodiversity credit projects to issue and sell the resulting credits.

Best Practice Setting

An organization that does one or more of the following: publishing important biodiversity market thought leadership research or industry papers, publishing scientific biodiversity research, having on-the-ground conservation presence, having international influence, undertaking biodiversity-related advocacy, being part or organizing industry coalitions, having heavy relevant social media presence.

Demand Facilitation

A company that helps attract more biodiversity credit end buyers but isn’t the end buyer itself (e.g. marketplace).

Measurement, Reporting & Verification

A company that does one or more of the following: producing their own 1st party biodiversity data, integrating it with other 3rd party biodiversity data sources, designing its own proprietary methods to analyze biodiversity data or providing infrastructure for reporting and verifying such data.

Nature Accounting

A software analytics platform or a consultancy that helps corporates understand their biodiversity footprint, create corporate nature strategy and/or report nature-related disclosures (yep, I’m aware of the big overlap between them and the MRV providers).

Funding

An organization that funds organizations or specific projects related to biodiversity markets.

Consultancy

A consulting firm that provides services related to biodiversity markets (e.g. nature strategy, biodiversity project development, biodiversity impact assessments, etc.).

Quality Assurance

A company solely focused on assessing the quality of biodiversity (or carbon) credits.

Media

A company that produces public content related to biodiversity markets. It can focus on news, market analysis or anything else.

Natural Capital

A company focused on building holistic, multi-disciplinary infrastructure for natural capital integration into the financial system.

Subcategories

Standard

An organization developing rule sets related to biodiversity markets. Examples include biodiversity credit standards (high-level rules on how to develop biodiversity credit projects), MRV standards (rules on how to quantify biodiversity and its change), reporting standards (rules on nature-related corporate disclosures).

Methodology

An organization developing a set of lowest-level rules on how to develop biodiversity credit projects & calculate biodiversity credits. Usually, the core topics covered are biodiversity unit quantification & monitoring.

Forum & Coalition

A multi-stakeholder initiative related to biodiversity markets. Its mission could be, for example, scaling high-integrity biodiversity markets, supporting the nature tech ecosystem, designing corporate nature disclosures, advocating for certain groups or scaling biodiversity credit demand.

Asset Manager

A biodiversity-focused fund that manages (usually) large amounts of capital and deploys it in many different ways.

Advice on how to use the database

I compiled this list with granular usability in mind. With different filters, you should quickly find the organizations you’re looking for.

With that in mind, these are the most important columns:

Description

Every description is custom-made. No fluff, all content. It should help you quickly understand what the organization actually does.

Categories

Unsurprisingly, I categorized every player. The problem is, many organizations are operating across different categories. That’s why, instead putting each player under single a large meta category, I opted out for multiple more granular ones. Some have 4, most have 1 or 2.

Most importantly, they’ve been ordered according to relevance. That means if a company is categorized under “Project Development” first and then “Measurement, Reporting & Verification” after, it is primarily a biodiversity/carbon project developer that has built its own proprietary MRV infrastructure to identify and ensure high quality projects.

Subcategories

Similar to categories, players have multiple subcategories as well. They’ve also been (mostly) ordered according to relevance to the organization.

Tags

An underrated column. Here, whenever I could, I listed specific characteristics of the organization (e.g. “carbon”, “IP and/or LC” or “marine”). Reason: surgical filtering.

Connections

Here I listed organizations that each player is connected to. It might be a forum they’re part of (e.g. BCA Forum) or company they have a strong connection to (e.g. same founder or commercial partnership).

As you can see, the database is designed to be sliced and diced. Again, for a video walkthrough, feel free to take a look here.

Summary

This feels like a compilation of my work over the past year. I really hope you find the database useful. Do let me know if you have any feedback or suggestions on how to make it more valuable.

Cheers!

Amazing work Simas, is there a way to submit information so you may add to the list?

Amazing work Simas!